Oracle (ORCL) shares dipped on Wednesday after reports the company is preparing to raise $15 billion through a multi-part bond sale. Bloomberg cited people familiar with the matter, noting the debt would support Oracle’s aggressive cloud infrastructure buildout, particularly contracts tied to artificial intelligence demand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company has positioned itself as a key supplier of compute power for firms like OpenAI. It has been winning multi-year deals that require significant upfront spending on data centers, chips, and networking capacity. Raising capital in debt markets allows Oracle to scale quickly without draining cash reserves, but it also adds to the company’s leverage profile.

Why Debt Instead of Equity?

From an economic perspective, issuing corporate bonds is often more attractive than selling equity because it preserves ownership and avoids dilution. Interest rates remain relatively high in 2025, but Oracle is betting it can lock in manageable borrowing costs today while AI-driven revenues grow in the future.

This is essentially a leveraged growth strategy in which the company borrows now and invests heavily in infrastructure. The plan is to rely on recurring subscription revenues from cloud and AI clients to pay down the debt. If demand holds up, bondholders get paid and shareholders enjoy higher returns. If demand falters, Oracle risks carrying a heavier debt load without sufficient earnings growth.

Here’s How Investors Could Feel It

For equity investors, the move shows both opportunity and risk. On the one hand, Oracle’s willingness to raise $15 billion shows confidence in its ability to capture long-term cloud and AI contracts. This investment could drive growth in revenue and margins, positioning Oracle alongside rivals like Microsoft (MSFT) Azure and Amazon Web Services (AMZN).

On the other hand, more debt means higher fixed costs and potential pressure on credit ratings. If interest rates rise again or AI adoption slows, the cost of servicing that debt could weigh on profits. Shareholders also need to consider that proceeds may be diverted toward stock buybacks, acquisitions, or refinancing rather than purely cloud expansion.

Oracle Taps Bond Markets for Multi-Part Sale

Oracle is selling the debt in as many as seven parts, a common structure for large corporate offerings that lets investors choose maturities across the yield curve. For bond buyers, Oracle’s offering could be appealing if yields come in above Treasuries and other investment-grade corporate paper, especially given the company’s strong cash flow.

But investors should weigh credit risk. Oracle’s leverage will climb with this sale, and its ability to maintain ratings depends on executing its cloud strategy and capturing AI-related revenue quickly enough to offset higher interest expenses.

AI Pushes Tech Giants to Spend Big

Oracle’s bond sale highlights a larger truth in today’s economy, which is that AI is capital-intensive. Building out the data centers, chips, and power capacity needed to support AI workloads requires tens of billions in upfront spending. For tech giants, that means leaning on debt markets even when balance sheets are strong.

Investors should note that companies betting on AI infrastructure are shifting risk profiles. While the payoff could be massive if adoption accelerates, debt-funded growth makes them more sensitive to interest rates, credit spreads, and execution risk.

To sum up, if contracts like OpenAI deliver the revenue streams management expects, the debt will look smart, fueling growth without shareholder dilution. If not, Oracle could face heavier leverage and tighter financial flexibility. For now, investors must balance optimism about AI-driven cloud demand with caution about rising debt loads.

Is Oracle a Good Stock to Buy?

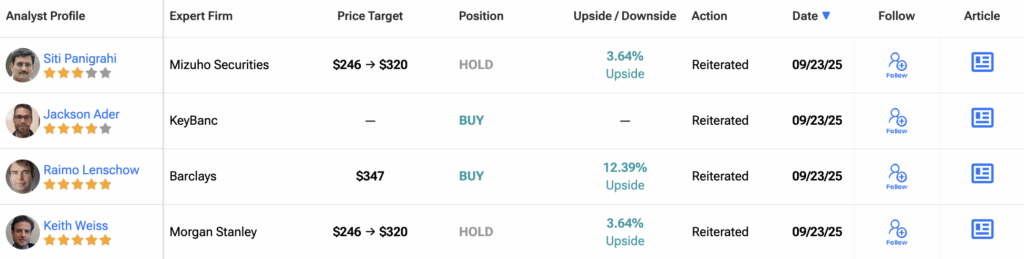

Wall Street remains constructive on Oracle despite the new debt sale. According to data from the past three months, 34 analysts have issued ratings on the stock. Out of those, 25 call it a Buy, nine rate it a Hold, and none recommend a Sell. This distribution gives Oracle an overall rating of Moderate Buy.

The average 12-month ORCL price target sits at $343.07, which implies an 11.5% upside from the current price.