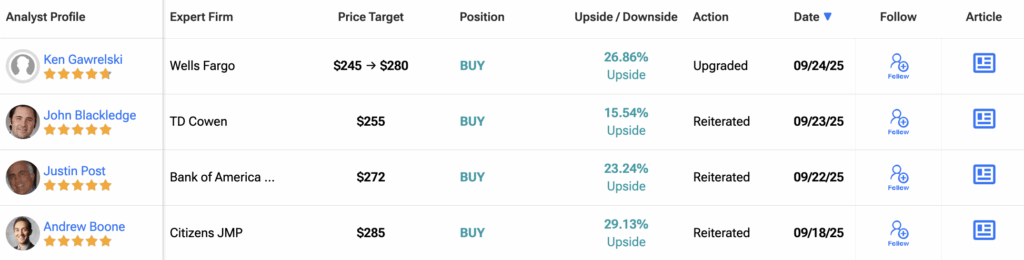

Amazon (AMZN) gained in premarket trading Wednesday after Wells Fargo turned bullish, upgrading the stock to Overweight from Equal Weight and lifting its price target to $280 from $245.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The call is built around Amazon Web Services, which Wells Fargo expects to regain momentum despite losing market share. “While share losses remain material, we take solace in stronger industry growth and rising AWS estimates,” said 5-star analyst Ken Gawrelski.

AMZN shares traded at $223.50 before the open, a modest rebound for the year’s worst performer in the Magnificent Seven. Amazon stock has barely gained in 2025, even as tech peers surged.

Project Rainier Is the Crucial Piece

The centerpiece of Wells Fargo’s thesis is Project Rainier, Amazon’s push to build a massive AI supercomputer powered by in-house Trainium chips.

Furthermore, he project will anchor Amazon’s Indiana data-center campus, with 1.3 gigawatts of computing capacity expected to go live in January and another 0.9 gigawatts ramping later. At full throttle, the site could generate $14 billion in annual revenue, Wells Fargo estimates.

Amazon’s $4 billion investment in AI startup Anthropic adds another layer, as the firm plans to train its models on Amazon’s chip clusters.

AWS Growth Set to Pick Up Speed

AWS has bled share in the cloud market, sliding from 47% in 2024 to a projected 32% by 2029, according to Wells Fargo. But analysts say the shrinking share masks the reality of an expanding overall pie.

With Rainier online, AWS growth should accelerate to 22% in 2026 from 19% in 2025, Wells Fargo forecasts. That trajectory could restore investor confidence in Amazon’s most profitable business.

Scaling the hardware will not be easy. Supply chains, customer adoption, and competition from Microsoft and Google remain hurdles. But Wells Fargo says its conviction in the AWS growth story is rising, making Amazon a stronger long-term bet.

Is Amazon a Good Stock to Buy?

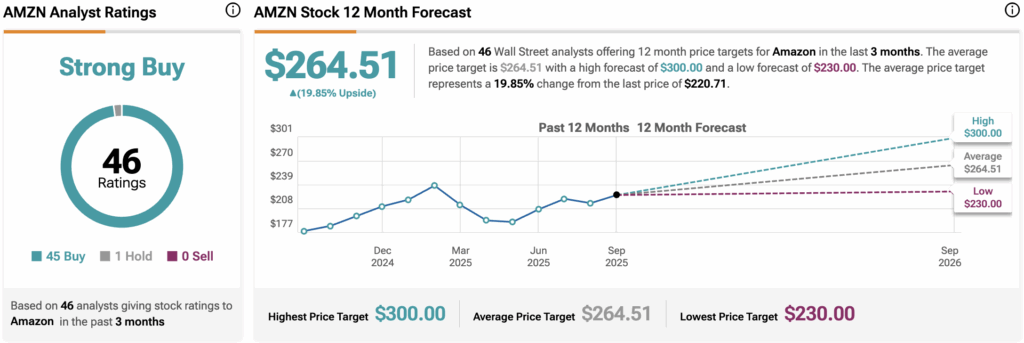

Wells Fargo is not alone in its optimism. AMZN stock has a consensus Strong Buy rating among 46 Wall Street analysts. That rating is based on 45 Buys and one Hold recommendation assigned in the last three months. The average 12-month AMZN price target of $264.51 implies 19.9% upside from current levels.

For now, Amazon’s core retail engine still matters, but Wall Street is watching AWS as the key swing factor. If Project Rainier delivers and AI demand scales, Amazon’s stock could finally break out of its 2025 slump.