Shares in enterprise software company Oracle (ORCL) were 3% higher today after a leading analyst said it was ready to set forecast-busting 2030 targets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Most Awaited

Derrick Wood of TD Cowen, who has a Buy rating on the stock and a price target of $375, said “top pick” Oracle’s upcoming analyst day next week was the most “awaited” event in 20 years.

He expects the company to set out fresh revenue and earnings targets for 2030, which will be “comfortably above consensus thought.”

Wood said his baseline assumption was for around $200 billion in revenues, $80 billion in EBIT and $20 in EPS. Let’s see how that compares with its current performance – see below:

“Based on our estimates this would represent a 5- year revenue compound annual growth rate of 29% and a CAGR for EPS of 28%,” he said.

One of the key drivers will be the massive $300 billion deal which it recently inked with ChatGPT maker OpenAI. The five-year agreement is set to begin in 2027, marking one of the largest cloud contracts in history. It positions ORCL as a key infrastructure provider for OpenAI’s growing AI needs.

Under the deal, OpenAI will purchase compute power from Oracle, using its expanding network of AI-focused data centers. The deal requires a huge 4.5 gigawatts of power, which is about as much as two Hoover Dams.

Stargate Boost

Wood said there is also plenty of mileage with the Oracle, OpenAI and SoftBank (SFTBY) Stargate data center project.

OpenAI and ORCL have disclosed they have secured over 5.5GW of data center capacity for Stargate across 4 major sites including New Mexico.

“Our field checks and analysis suggests this incorporates the purchase of around 2.6 million GPUs and at full production around 2030 will generate over $60 billion in annual revenues for Oracle,” he said.

The TD Cowen optimism will be welcome for Oracle investors who were rocked earlier this week when it revealed that gross profit margin from its AI cloud business was lower than estimated on Wall Street. Its shares dropped around 3% on the move but have recovered today.

Is ORCL a Good Stock to Buy Now?

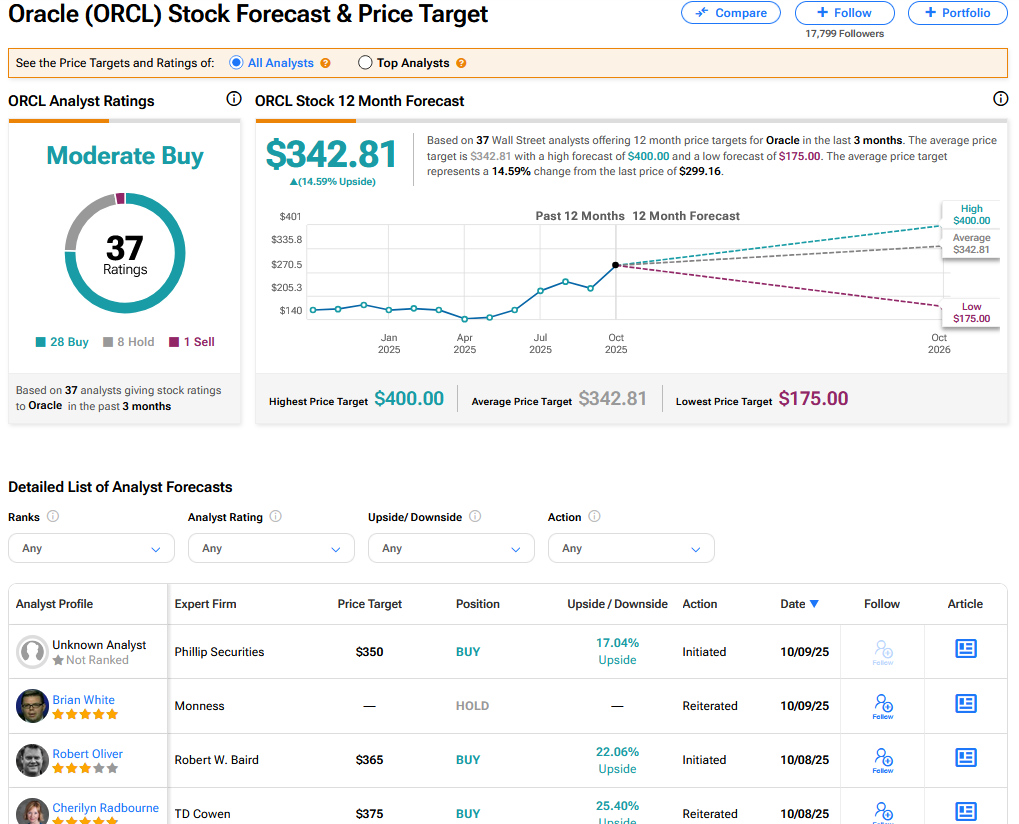

On TipRanks, ORCL has a Moderate Buy consensus based on 28 Buy, 8 Hold and 1 Sell ratings. Its highest price target is $400. ORCL stock’s consensus price target is $342.81, implying a 14.59% upside.