After market close today, Canadian tech information management company OpenText (TSE:OTEX) (NASDAQ:OTEX) reported its Fiscal Q3-2023 earnings results, which beat both revenue and earnings-per-share (EPS) expectations. All figures are in U.S. dollars unless otherwise stated.

Q3 Revenues

OpenText’s total revenue reached $1.24 billion, representing 41.1% year-over-year growth, or a 44.9% increase in constant currency, surpassing the $1.18 billion consensus estimate. Cloud revenues contributed greatly to this growth, with a 10.4% increase in constant currency, amounting to $435 million. Further, OTEX’s annual recurring revenues (ARR) rose by 41.1% in constant currency to $1.01 billion, accounting for 81% of total revenues, and enterprise cloud bookings remained stable at $108 million.

CEO & CTO Mark J. Barrenechea highlighted the company’s successful integration of Micro Focus and the nine consecutive quarters of organic cloud revenue growth and organic ARR growth in constant currency.

Q3 Profits

The company reported diluted adjusted EPS of $0.73, beating the $0.45 consensus estimate, while GAAP-based diluted EPS stood at $0.21. OpenText’s adjusted EBITDA was $365 million, with a margin of 29.3%, and its TTM adjusted EBITDA reached $1.32 billion, a 34% margin. Lastly, operating cash flows amounted to $337 million, and free cash flows were $306 million.

Is OTEX Stock a Buy, According to Analysts?

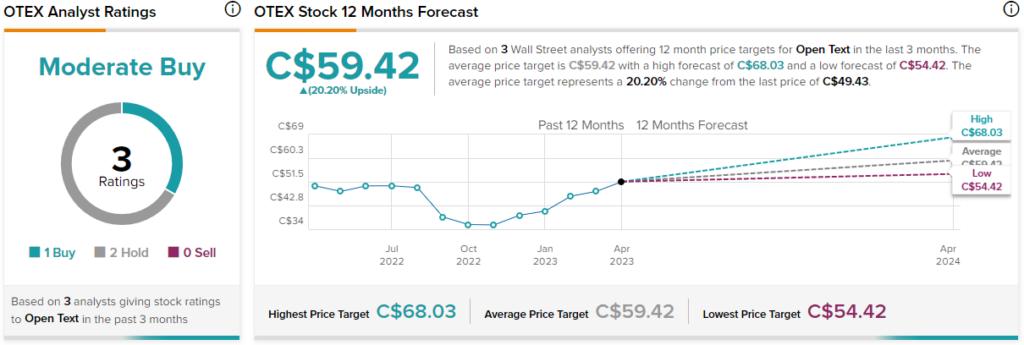

According to analysts, OpenText stock earns a Moderate Buy consensus rating based on one Buy and two Holds assigned in the past three months. The average OTEX stock price forecast of C$59.42 implies 20.2% upside potential. Analyst price targets range from a high of C$68.03 to a low of C$54.42.