Opendoor Technologies (OPEN) stock plunged 12% in Monday’s regular trading session and was down about 6% in extended trading. The decline was sparked by unfavorable comments made on X by hedge fund manager George Noble, who slammed Opendoor’s business model and called the online real estate company “total garbage.” OPEN stock was down more than 4% in Tuesday’s pre-market trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Hedge Fund Manager Warns Investors About Opendoor Stock

Noble, who has founded two billion-dollar hedge funds and was an assistant to popular investor Peter Lynch, pointed out that Opendoor has lost money every single year since it was founded. He added that OPEN’s business model doesn’t work and had “atrocious” unit economics. Noble also believes that the company’s cost reduction efforts “will not move the needle.”

Noble cautioned investors about OPEN stock’s lofty valuation despite weak fundamentals. He noted that OPEN stock trades at 22x EV/revenue (enterprise value/revenue), with a “lousy balance sheet and is perennially loss-making.” In contrast, the hedge fund manager highlighted that rival Compass (COMP) trades at 0.9x EV/revenue, has a strong balance sheet, and is profitable.

“Go ahead and speculate if you wish, but don’t DARE pretend that there is a fundamental case,” said Noble.

Despite yesterday’s selloff, Opendoor stock is still up about 424% year-to-date. The bullish comments about Opendoor by Eric Jackson, the founder and president of EMJ Capital, in July sparked a meme stock rally. Interestingly, on Monday, the hedge fund manager triggered a massive rally in Better Home & Finance Holding (BETR) stock.

What Is the Price Target for Opendoor Stock?

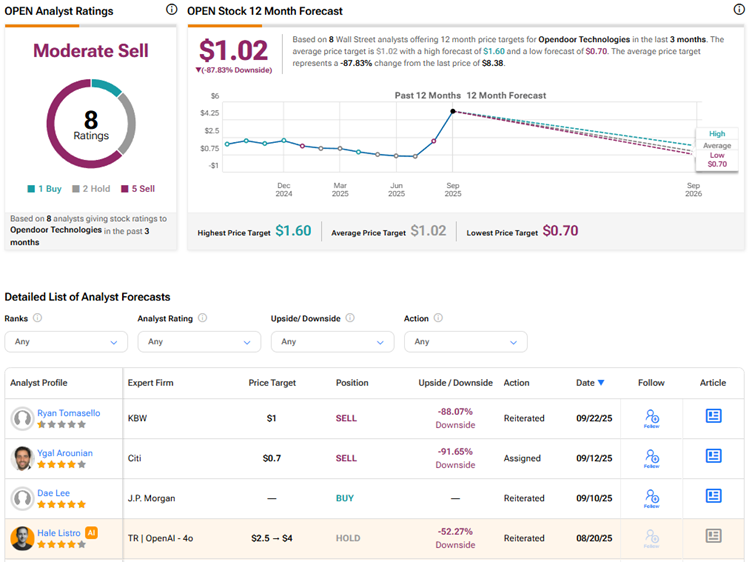

Wall Street has a Moderate Sell consensus rating on Opendoor Technologies stock based on one Buy, two Holds, and five Sell recommendations. The average OPEN stock price target of $1.02 indicates about 88% downside from current levels.