OpenAI (PC:OPAIQ) has been very active lately, striking new partnerships and deals with several major companies, including Nvidia (NVDA), Oracle (ORCL), CoreWeave (CRWV), Broadcom (AVGO), and AMD (AMD). Now, according to a Financial Times report, the ChatGPT creator is looking for new ways to raise money and expand its business. The company has pledged more than $1 trillion in spending tied to its next wave of AI projects. To meet those promises, it plans to boost income from business clients, government contracts, and new consumer tools built around its models.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the same time, OpenAI is exploring new types of debt funding to help build more data centers. It is also studying ways to earn revenue from its own computing network, known as Stargate. That plan would allow OpenAI to become a supplier of AI power, not just a developer of software. In addition, the company is working with former Apple (AAPL) designer Jony Ive on an AI-powered personal device, which could mark its first major step into hardware.

Growing Revenue and Cutting Losses

OpenAI currently generates about $13 billion in annual recurring revenue. Around 70% of that comes from ChatGPT users, most of whom pay $20 per month. Out of roughly 700 million active users, only 5% are paying subscribers, but the company aims to double that figure. It has already introduced lower pricing in India and plans to roll out similar options in countries like Brazil and the Philippines.

In addition to subscriptions, OpenAI now takes a small cut from product sales made through ChatGPT’s new shopping tools. It is also considering adding ads to its products, though leaders say they will move carefully. Its recent collaborations with Nvidia and AMD include joint work on improving chips and data center design.

However, the company remains unprofitable. OpenAI reported an $8 billion operating loss in the first half of 2025, even as its revenue more than doubled from the prior year. Partners such as Oracle have covered much of the early infrastructure spending, while OpenAI plans to repay those costs as its business scales.

Big Commitments

OpenAI has agreed to secure more than 26 gigawatts of computing capacity from Nvidia, AMD, Broadcom, and Oracle. That amount equals the power output of about 20 nuclear plants. These contracts could exceed $1 trillion over ten years, with about two-thirds of the total tied to semiconductors. OpenAI expects falling chip prices and rising competition among suppliers to help reduce its costs over time.

Although some analysts say these deals recycle capital between OpenAI and its investors, they also signal market confidence in the company’s ability to secure financing. OpenAI believes this approach will help it raise more debt and maintain its lead as demand for large-scale AI systems grows.

Chief executive Sam Altman has said that turning a profit is not a top priority for now. Meanwhile, president Greg Brockman believes that greater computing power could eventually bring much higher revenue. For the moment, OpenAI’s focus remains clear: grow quickly enough to fulfill its commitments and turn its heavy spending into a stable long-term AI business.

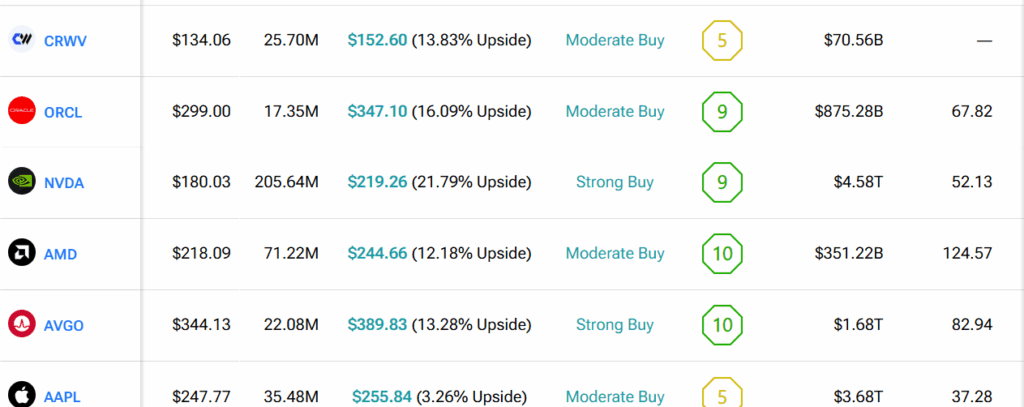

By using TipRanks’ Comparison Tool, we’ve compared all the tickers appearing in the piece. This is a great way for investors to gain a comprehensive look at each stock and the industry as a whole.