Microsoft’s (NASDAQ:MSFT) move to back OpenAI is proving to be quite the winner. Just yesterday, we were detailing the incredible growth that OpenAI has seen so far. That came with vague rumblings about a potential stock sale in the offing, and now, those rumblings appear to be coming to pass. The upcoming stock offer will, ultimately, value OpenAI at $90 billion. However, it will be a private stock tender offer, reports note, and it’s expected to close next Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A substantial quantity of interest is already in place—which isn’t surprising—and quite a bit of that is from the Middle East. However, reports suggest that fundraising may be a problem, given the still-ongoing Israel-Hamas war. Earlier reports suggested that OpenAI would be valued at around $80 billion, back when OpenAI was looking to allow employees to sell their shares. However, that value seems to have improved since.

Perhaps most unexpected of all, OpenAI is already taking its earnings and investing in other AI operations as well. OpenAI recently put $8 million worth of investment into Anysphere, which is working to build an “AI-native software development environment.” That’s actually the bulk of Anysphere’s funding; the company currently has $11 million to its name. Once it gets going in earnest, Anysphere will offer up a platform that allows for faster development, shorter time-to-market, and ultimately, more AI applications developed.

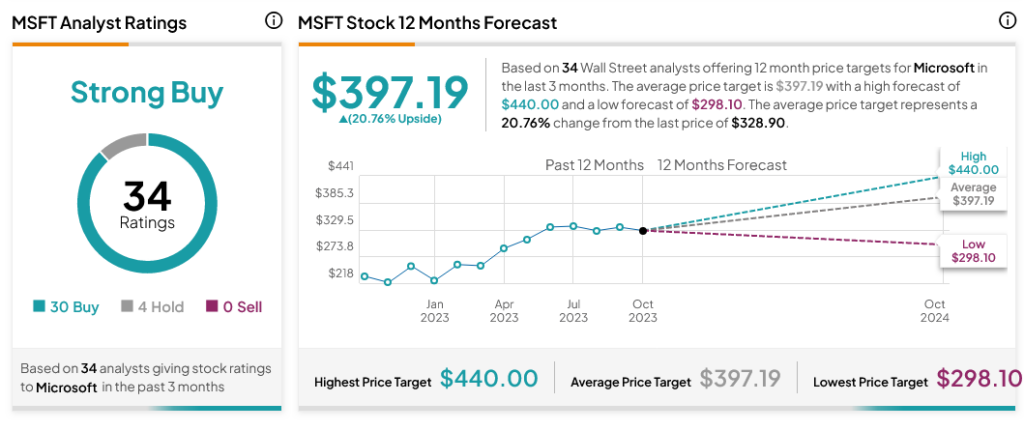

What is the MSFT Forecast for 2023?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 30 Buys and four Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSFT price target of $397.19 per share implies 20.76% upside potential.