Computing leader Microsoft (NASDAQ:MSFT) has no shortage of wins these days, even as it tackles a tax bill so substantial it’s a match for entire countries’ GDP. And its backing of OpenAI, meanwhile, is also likely to pay off some dividends eventually, as its sales are spiking. The latest word from Sam Altman is downright staggering, but it wasn’t quite enough to budge Microsoft upward, as it’s down fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word out of OpenAI, via Sam Altman, its CEO, is that OpenAI is pulling in a hefty $1.3 billion annually in sales. Broken down by month, that’s better than $100 million and up 30% just from this summer. Back in 2022, meanwhile, those sales were just $28 million. Conversational chatbot subscriptions are leading the way in producing revenue, and with AI itself proving a hot topic for investors up and down the spectrum, there’s certainly interest enough to go around. Some reports suggest that OpenAI is planning to allow employees to sell shares at prices that would make OpenAI valued at around $80 billion.

With that in mind, OpenAI likely also knows that growth is finite, and it needs to keep that growth going as long as possible. Thus, OpenAI is planning to get more attention on itself and draw in more developers by calling attention to development costs. It’s even planning some features to help on that front, including memory storage, which by itself could cut costs up to 20 times over, note reports. That would take OpenAI from a gee-whiz toy for consumers and make it a full-on developer machine as well.

What is the Fair Value for Microsoft?

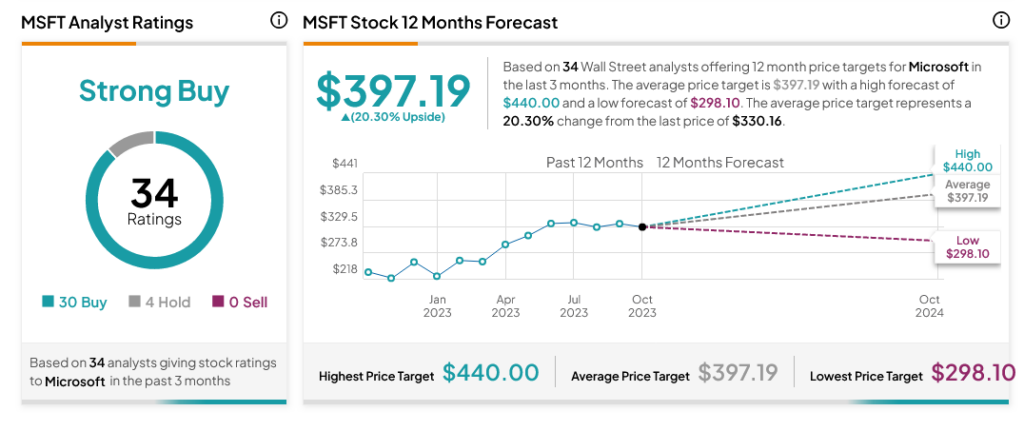

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 30 Buys and four Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSFT price target of $397.19 per share implies 20.3% upside potential.