OneMain Holdings, Inc. (OMF) delivered stronger-than-expected third-quarter earnings driven by robust growth in receivables, aided by the company’s strategic initiatives and a rebound in economic conditions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, shares of the consumer finance and insurance company fell 1.5% in Wednesday’s extended trading.

In Q3, adjusted earnings of $2.37 per share beat analysts’ expectations of $2.29 per share. The company reported earnings of $2.19 per share in the prior-year period.

Net interest income after the provision for finance receivable losses came in at $650 million, up 8.3% year-over-year. (See OneMain Holdings stock charts on TipRanks)

Managed receivables, including loans serviced for whole loan sale partners, were $19.1 billion on September 30, 2021, compared to $17.8 million in the prior-year period.

The company recorded a provision for finance receivable loss of $224 million, down from $232 million in the prior-year quarter. The decline was primarily driven by lower net charge-offs due to improved credit performance, aided by government stimulus payments.

During the quarter, the net charge-off ratio was 3.52%, down from 4.41% in the prior quarter and 5.20% in the prior-year quarter.

OneMain CEO Doug Shulman commented, “During the third quarter demand for our core lending products was strong, and we also initiated the roll-out of our BrightWay credit cards, which we expect will be the next driver of growth for our company.”

He further added, “With our leading lending products, a credit card that reinforces credit-building behaviours, and a suite of financial wellness solutions under Trim, we continue to execute on our vision of being the lender of choice for near-prime consumers.”

Following the earnings results, JMP Securities analyst David Scharf maintained a Buy rating on OneMain Holdings with a price target of $72.80 (20.8% upside potential).

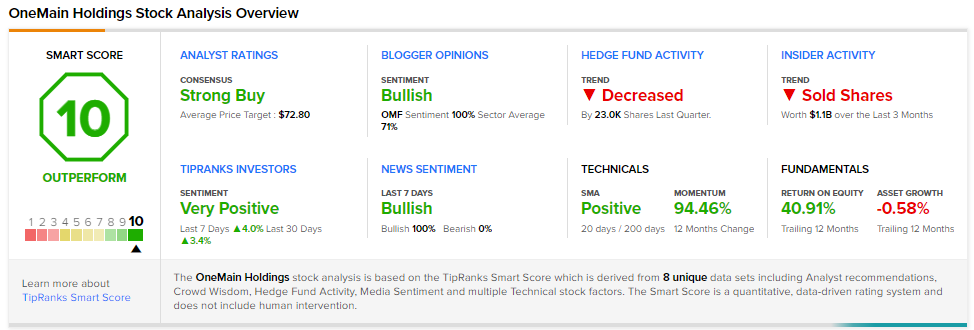

Consensus among analysts is a Strong Buy based on 10 unanimous Buys. The average OneMain Holdings price target of $72.80 implies 20.8% upside potential to current levels.

OMF scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Winnebago Industries Posts Q4 Beat; Shares Pop 2.4% in Pre-Market

Stride Delivers Upbeat Revenues in Q2; Shares Gain 5% After-Hours

Intuitive Surgical Beats Q2 Earnings Expectations; Shares Rise