Stride, Inc. (LRN) shares jumped 5% in Tuesday’s extended trading session after the company delivered strong fiscal 2022 first-quarter revenues. The company also provided second-quarter and FY2022 revenue guidance above analyst expectations.

Shares of the online education services provider have gained 63% year-to-date. (See Stride stock charts on TipRanks)

Revenues jumped 7.9% year-over-year to $400.2 million and exceeded consensus estimates of $359.48 million. The increase in revenues reflected a surge in revenue per enrollment, robust middle and high school career learning enrollments, and growth in adult learning.

However, the company reported a net loss of $0.15 per share, falling a cent short of analysts’ expectations of a loss of $0.14 per share. The company reported earnings of $0.30 per share in the prior-year period.

Based on strong demand for high-quality online education, the company expects FY2022 revenue to range between $1.56 – 1.6 billion, while the consensus estimate is pegged at $1.47 billion. For Q2 FY22, revenue is expected to be between $390 – 400 million versus the consensus estimate of $365 million.

Sharing his optimism for the coming future, Stride CEO James Rhyu commented, “Our roadmap of new products and customer improvements is more robust, than it has been in the over eight years that I’ve been with the company. Be on the lookout for some exciting new product announcements during the upcoming year.”

However, he cautioned, “Teacher shortages have been a real threat to the U.S. education system for many years, and the pandemic has only exacerbated this risk. We’re thankful for the thousands of wonderful teachers we manage, but these shortages have limited our ability to enroll new students in some states.”

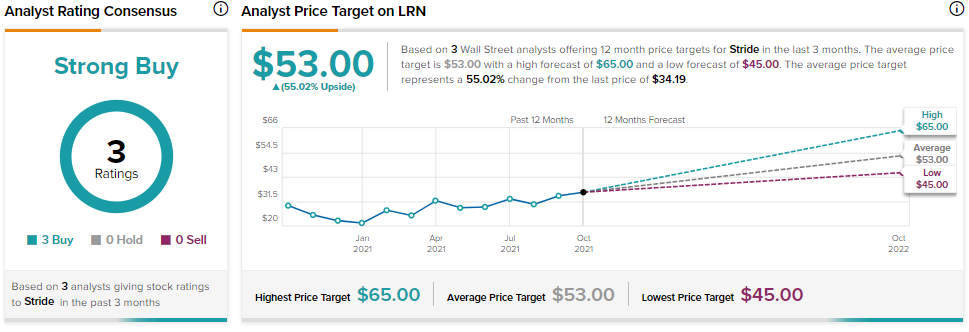

Last week, BMO Capital analyst Jeffrey Silber increased the price target on Stride, Inc. to $49.00 (43.3% upside potential) from $45.00 and reiterated a Buy rating.

Overall, the stock has a Strong Buy consensus rating based on 3 unanimous Buys. The average Stride price target of $53 implies 55% upside potential from current levels.

Related News:

Zions Bancorporation Reports Q3 Beat; Shares Fall 2.1% After-Hours

Equity Lifestyle Properties Reports Q3 Beat

Zillow Suspends Signing of New Contracts through 2021; Shares Plunge 9.5%