ON Semiconductor Corporation (NASDAQ:ON) has urged its shareholders to reject the mini-tender offer from TRC Capital Investment Corporation, a Canadian investment firm. TRC plans to acquire 1.5 million shares of the semiconductor company for $70.75 per share, reflecting a discount of 4.4% from its closing price of $74.04 on March 19, 2024, the day before the offer.

The company clarified that it has no association or affiliation with TRC Capital or its offer, and it advised stockholders against tendering their shares. ON Semiconductor opposes TRC Capital’s offer as it is lower than its current market price. Further, as mini-tender offers do not require numerous disclosures and procedural obligations enforced by the SEC, they lack comprehensive investor protections mandated by the SEC.

ON Semiconductor’s Performance

ON Semiconductor stock has fallen over 13% in one year as macroeconomic headwinds and a slowdown in industrial activity remained a drag on its financials. However, the company is readjusting its portfolio and focusing on products with higher gross margins. Further, ON Semiconductor is expanding its customer base and growing its automotive revenue with intelligent power and sensing technologies.

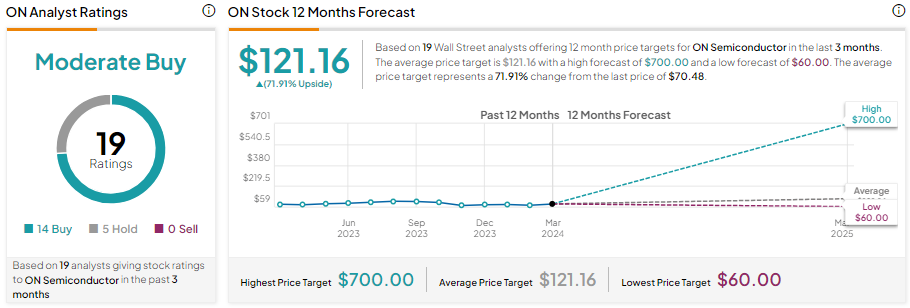

What Is the Prediction for ON Semiconductor?

While the company is reshaping its product portfolio, slowing end demand keeps analysts cautiously optimistic about its prospects. However, the company will likely benefit significantly as end-market demand recovers.

ON Semiconductor has 14 Buys and five Hold recommendations for a Moderate Buy consensus rating. Analysts’ average ON stock price target of $121.16 implies 71.91% upside potential.