Amid challenging economic conditions and high unemployment, customers are looking for value deals at discount stores and off-price retailers. Also, a shift in spending towards food, essentials and home goods has been observed during the COVID-19 pandemic as travel, entertainment and dining at restaurants have taken a back seat. Another key trend has been the spike in e-commerce sales as customers are still reluctant to visit stores given the rising COVID-19 cases.

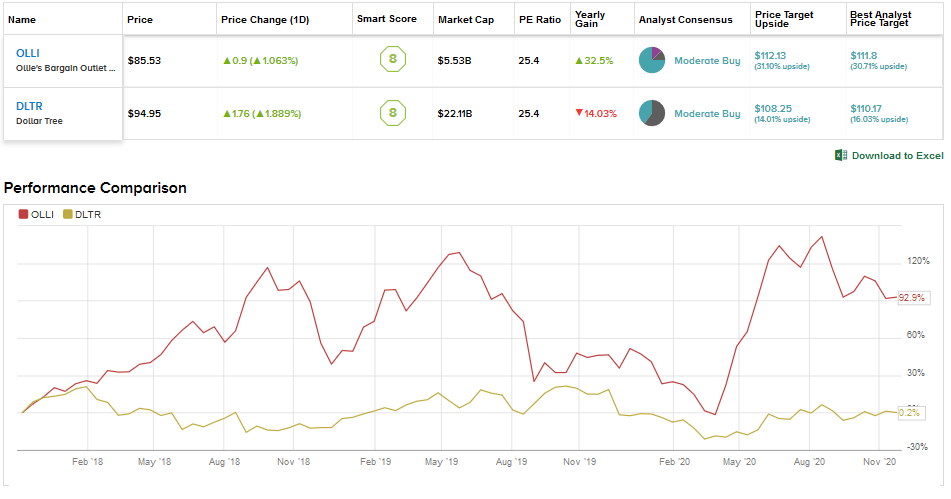

Keeping in mind the changing dynamics in the retail space, we will use the TipRanks Stock Comparison tool to compare Ollie’s Bargain and Dollar Tree to determine the better retail stock.

Ollie’s Bargain Outlet Holdings (OLLI)

Ollie’s Bargain is a value retailer that sells branded merchandise like houseware, food, books and stationery, bed and bath, floor coverings, toys and hardware at significantly lower prices. It buys closeout merchandise and excess inventory from other retailers and manufacturers and passes on the benefit of reduced prices to the consumers. As of 2Q FY20 (ended Aug. 1), the company operated 370 stores across the US.

Because of its exposure to essentials, Ollie’s continued to operate its stores unlike several other retailers, which suffered due to pandemic-led closures. The company’s 2Q FY20 sales jumped 58.5% year-over-year to $529.3 million, backed by comparable store sales growth of 43.3% and sales contribution from new stores. Ollie’s attributed the higher sales to government stimulus and the spike in demand for essentials amid the pandemic.

Merchandise categories that performed well in 2Q included health and beauty aids, housewares, bed and bath, flooring, and electronics. Adjusted EPS surged 197% year-over-year to $1.04, driven by strong sales coupled with gross margin expansion (increased 190 basis points to 39.1%) on tight expense controls.

Ollie’s did not provide any specific guidance for the third quarter or full-year but stated that comparable sales were trending in the high teens. However, the company cautioned that it expects slower growth as the year progresses. (See OLLI stock analysis on TipRanks)

Even during these challenging times, the company opened 23 new stores in the first half of FY20 and plans to open 46 new stores over the entire fiscal year. Over the long-term, Ollie’s believes that it can expand its store base to 1,050 stores.

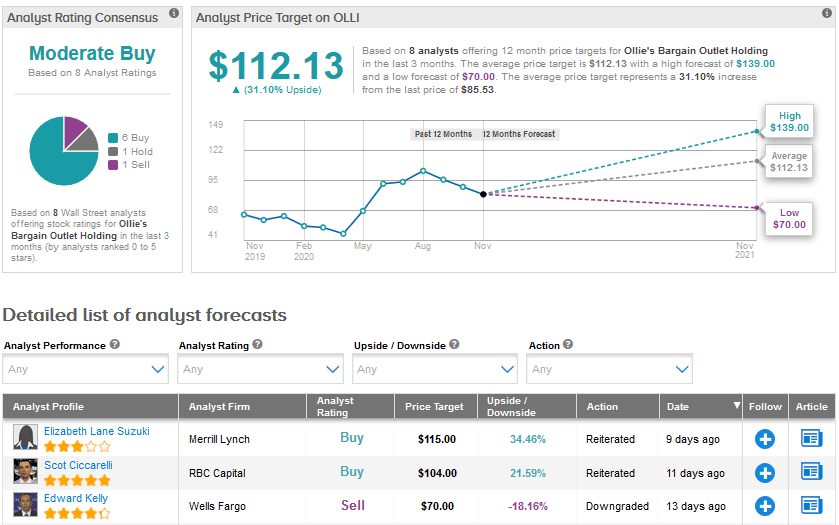

In September, KeyBanc analyst Bradley Thomas reiterated a Buy rating for Ollie’s with a price target of $120 following meetings with senior management. Thomas stated, “While 2021 will prove a difficult comparison, we believe that is widely understood by investors. We believe OLLI still has a compelling LT growth opportunity, benefiting from strong closeout availability and as consumers look for value.”

Thomas added, “Management has indicated its belief that moderation will continue throughout 2H as the stimulus impact wanes and competitors reopen stores. While trends are decelerating, we believe the backdrop remains in place for OLLI to post above normal comp growth until at least 1Q21. Through September, our Key First Look Data implies the current consensus estimate of 12% for 3Q comps could have upside, potentially at the mid- or high-teens level.”

Shares have already risen 30.8% year-to-date and the average analyst price target of $112.13 suggests further upside potential of 31.1% in the coming months. Overall, the Street has a cautiously optimistic outlook on Ollie’s, with a Moderate Buy analyst consensus based on 6 Buys, 1 Hold and 1 Sell.

Dollar Tree (DLTR)

Dollar Tree is one of the largest retailers, operating over 15,479 stores in the US and Canada under the Dollar Tree, Family Dollar, and Dollar Tree Canada brands. Stores under the Dollar Tree brand sell merchandise at $1 while Family Dollar stores offer merchandise at competitive prices. The retailer has also been testing multi-price points ($5 or below) at its Dollar Tree branded stores.

Prior to the pandemic, Dollar Tree was under pressure due to its Family Dollar stores, which it acquired in 2015. The company has been focusing on streamlining its Family Dollar business by closing unprofitable stores, renovating some stores and rebranding others to the Dollar Tree brand.

The company’s restructuring efforts and the pandemic-induced demand for food and essentials helped in driving an 11.6% year-over-year same-store sales growth in the Family Dollar stores in 2Q FY20 (ended Aug. 1). Meanwhile, same-store sales at the Dollar Tree branded stores rose 3.1%, bringing the overall same-store sales growth to 7.2%. Consolidated sales grew 9.4% year-over-year to $6.28 billion and 2Q EPS increased 44.7% to $1.10 on improved margins (gross margin expanded 180 basis points to 30.5%).

Dollar Tree opened 131 new stores, expanded or relocated 22 stores, and closed 26 stores in 2Q FY20. It also renovated 76 Family Dollar stores to the H2 format (this new format has more coolers and enhanced consumable offerings along with other features). The retailer expects to open 325 new Dollar Tree stores and 175 Family Dollar stores in FY20. It also aims to complete the renovation of 750 Family Dollar stores to the H2 format this fiscal year.

Meanwhile, Dollar Tree is gearing up for the crucial holiday season. Last month, it announced plans to hire over 25,000 employees to support holiday sales. (See DLTR stock analysis on TipRanks)

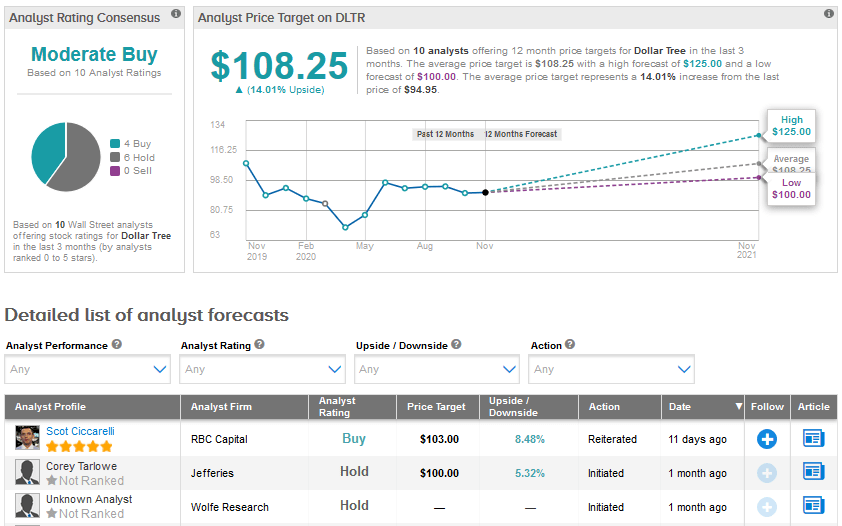

In reaction to the 2Q results, Piper Sandler analyst Peter Keith reiterated a Buy rating with a price target of $113 saying, “Q3 is off to a good start from a sales perspective, but core-DLTR EBIT continues to be lackluster and trend down y/y, which stifles EPS growth for the model overall.”

Keith further explained, “And while COVID dynamics are certainly an external tailwind that can last through 2H and into 2021, we have trouble pointing to needle-moving internal initiatives at this time. Valuation at ~16x our NTM EPS is somewhat attractive vs. a three-year mean of 17x and margin compares for core-DLTR remain easy through 2H.”

Overall, 4 Buys and 6 Holds with no Sell ratings add up to a Moderate Buy analyst consensus for Dollar Tree. Shares have advanced just 1% year-to-date. The average analyst price target stands at $108.25, reflecting an upside potential of 14% in the coming 12 months.

Conclusion

Ollie’s Bargain delivered better growth rates than its bigger rival Dollar Tree in 2Q FY20 and is well-positioned to grow rapidly, though the growth rate is expected to moderate. What’s more, the stock has outperformed Dollar Tree so far this year and still has greater upside potential in the coming months. Overall, Ollie’s Bargain appears to be a better pick than Dollar Tree currently.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment