Identity management platform provider Okta, Inc. (OKTA) recently posted a better-than-expected top-line for the third quarter, driven by robust subscription revenue growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Okta’s net loss per share came in narrower than analysts’ estimates during this period. Furthermore, the company’s remaining performance obligations increased 49% year-over-year to $2.35 billion.

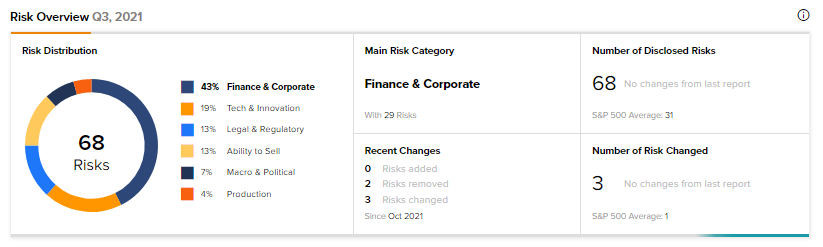

With these developments in mind, let us take a look at the changes in Okta’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Okta’s top risk category is Finance & Corporate, contributing 43% to the total 68 risks identified. In its recent quarterly report, the company has changed three key risk factors under the Finance & Corporate risk category.

Okta highlighted that its common stock has a dual-class structure, which means that stockholders who held Okta’s capital stock prior to its IPO have a higher voting control (42.8%) in the company. This factor limits the ability of other investors to influence corporate matters in Okta.

Secondly, Okta acknowledged that the purchase price accounting associated with its acquisition of Auth0 requires estimates, which may change and in the future could impact Okta’s condensed financial statements and results of operations. (See Insiders’ Hot Stocks on TipRanks)

Lastly, Okta also noted that its acquisition of Auth0 could lead to disruptions in its business. The integration of Auth0 may also result in a substantial burden on Okta’s management and internal resources. Any diversion in Okta’s management’s attention may adversely affect its financial results.

Compared to a sector average of 40%, Okta’s Finance & Corporate risk factor is at 43%.

Wall Street’s Take

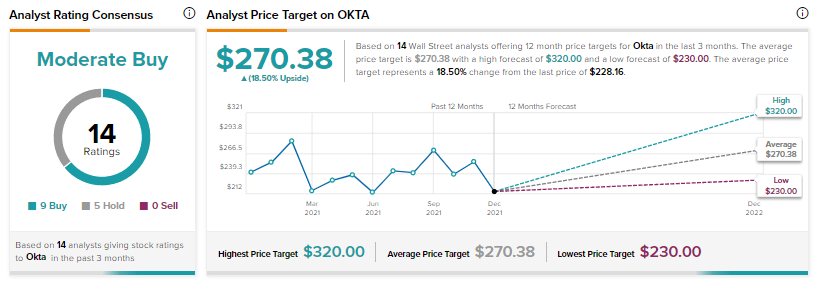

On December 3, Deutsche Bank analyst Patrick Colville reiterated a Buy rating on the stock but decreased the price target to $250 from $270.

Consensus on the Street is a Moderate Buy based on 9 Buys, and 5 Holds for the stock. The average Okta price target of $270.38 implies a potential upside of 18.5% for the stock. That’s after an 11.6% drop in Okta’s share price over the past month.

Related News:

Kraft Heinz Reveals Plan to Merge U.S. and Canada Operations

Camping World to Deepen Hold in Michigan with Lloyd Bridges Buyout

Perion Raises Outlook on Strong Momentum, Announces Shares Offering