Advertising technology company Perion Network Ltd. (PERI) has revised guidance for full-year 2021 and 2022 upward on continued acceleration in its business momentum. Also, to fund its growth, Perion has announced a follow-on offering of its common stock.

Raised Guidance

Perion has witnessed 115% year-over-year growth in Video and CTV, including Vidazoo, and a significant rise in average deal size and revenue retention. Also, in the first two months of the current quarter, the daily average number of monetizable searches grew 13%.

Therefore, backed by the strong performance so far, the company has raised its revenue and adjusted EBITDA outlook. (See Perion stock charts on TipRanks)

For 2021, Perion has raised the revenue guidance to $460 million to $470 million from the prior expectations of $455 million to $465 million. Additionally, adjusted EBITDA is expected to be between $64 million and $65 million, compared to $59 million and $61 million previously guided.

Similarly for 2022, revenue expectations currently stand at $590 million to $610 million, up from $580 million to $600 million.

The CEO of Perion, Doron Gerstel, said, “We could not be more pleased by these results confirm our overall diversification strategy and operational excellence. The revised guidance reflects the success of our breakthrough high impact creatively led formats, especially for video and CTV. We are encouraged by the superior ROI and improved media margin that our innovative iHub platform provides.”

Proposed Shares Offering

Meanwhile, the company has launched a common stock public offering of about $100 million. Also, the underwriters have been granted an option to purchase additional ordinary shares to be sold in the offering on the same terms and conditions.

The net proceeds from this offering are likely to be used to fund the growth of the business, which includes any potential merger or acquisition opportunities that may arise and for additional working capital or general corporate purposes.

Wall Street’s Take

Last month, Roth Capital analyst Jeff Martin maintained a Buy rating on Perion and raised the price target to $43 from $40. The new price target implies 75.8% upside potential from current levels.

Martin is of the opinion that there is scope for robust growth in Perion’s display advertising business.

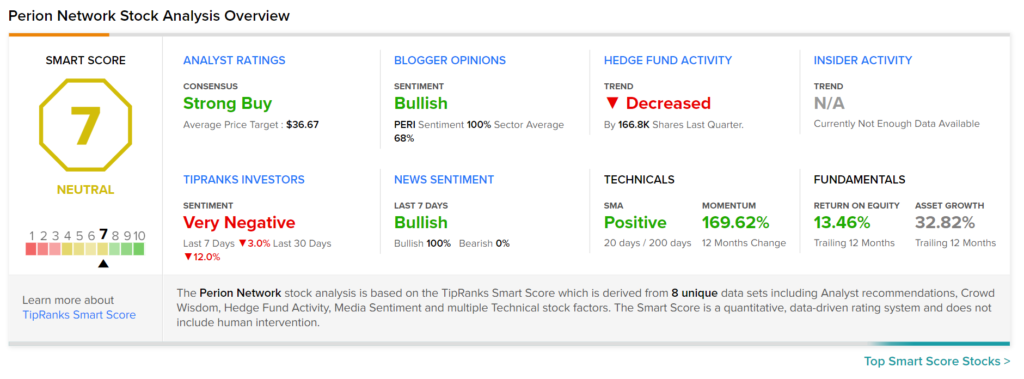

Overall, the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on 3 Buys. The average Perion price target of $36.67 implies upside potential of about 49.9% from current levels.

Smart Score

According to TipRanks’ Smart Score system, Perion gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

See Top Smart Score Stocks on TipRanks >>

Related News:

Johnson Controls Hikes Quarterly Dividend by 26%

Couchbase Falls 2.6% on Quarterly Loss

Equinix to Build Presence in Africa with MainOne Acquisition