Identity management services provider Okta (NASDAQ: OKTA) has reported better-than-anticipated results for the fiscal first quarter ended April 30, 2022. Further, the company has raised its outlook for FY23.

Shares of the company rallied 17.2% in Friday’s pre-market trading session, at the time of writing, after jumping 18% in Thursday’s extended trade.

Okta adds authentication and authorization services to a client’s applications, helping them track and manage the users who can access their applications.

Results in Details

Total revenues grew 65% year-over-year to $415 million, surpassing analysts’ estimate of $388.9 million. The top-line growth was driven by a 66% rise in the Subscription revenue, which stood at $398 million.

The first-quarter revenue growth reflected the contribution from Auth0, a cloud-native identity and access management solutions provider, which was acquired by Okta in May 2021.

Meanwhile, adjusted loss per share widened to $0.27 from $0.10 in the year-ago quarter. However, the figure came in better than analysts’ loss estimate of $0.34 per share.

Outlook

For the fiscal second quarter, Okta expects total revenues in the range of $428 million to $430 million and an adjusted loss per share of $0.31 to $0.32. This outlook is better than analysts’ expectations of a loss of $0.34 per share on revenues of $422.7 million.

Meanwhile, the company has raised its FY23 outlook. The company now anticipates revenues in the range of $1.805 billion to $1.815 billion. Further, it forecasts an adjusted loss per share between $1.11 and $1.14. Okta had previously anticipated revenues in the range of $1.78 billion to $1.79 billion and adjusted loss per share between $1.24 and $1.27.

Website Traffic

According to TipRanks’ Website Traffic Tool, the footfall on the company’s website has grown 106.99% year-to-date, compared to the previous year. This tool uses data from SEMrush Holdings (SEMR), the world’s largest website usage monitoring service.

As per the tool, the website traffic on okta.com grew 113.95% year-over-year in the first quarter of FY23. Given Okta’s strong results, it is evident that TipRanks’ website traffic tool helps in making reliable predictions about a company’s performance.

Wall Street’s Take

Following the results, Robert W. Baird analyst Jonathan B. Ruykhaver stated that he was glad to see that the security breach by Lapsus$ hacker group did not have any quantitative impact on the first-quarter business. That said, Ruykhaver remains cautious as management continues to investigate the matter.

The analyst noted that Okta added 800 new customers in the first quarter, bringing the total customer count to 15,800, up 48% year-over-year. Also, customers with an annual contract value of over $100,000 grew more than 59% to 3,305. Ruykhaver feels that these numbers were better-than-expected, especially given the Lapsus$ security breach earlier in the quarter.

With a price target of $125, Ruykhaver has reiterated a Hold rating on the stock.

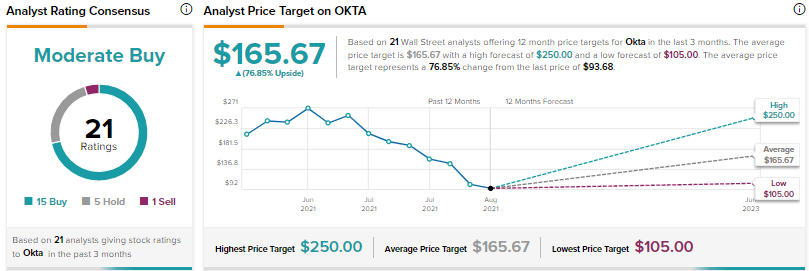

Overall, the Street is cautiously optimistic about Okta and has a Moderate Buy consensus rating based on 15 Buys, five Holds, and one Sell. Okta’s average price target of $165.67 implies upside potential of 76.85% from current levels.

Conclusion

Though Okta’s losses widened in the first quarter, its performance was better than what analysts feared. The company continues to gain from robust demand for identity management services as more enterprises embrace digital transformation.

Read full Disclosure