Oil prices are recovering on Oct. 13, but remain below the key support level of $60 a barrel as commodities investors continue to focus on U.S.-China trade relations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

West Texas Intermediate (WTI) crude oil, the U.S. standard, is trading at $59.98 a barrel in early-morning action on Oct. 13. At the same time, Brent crude oil, the international benchmark, is trading at $63.75 per barrel. Each oil price is up about 2% after losing 4% on Oct. 10 and hitting their lowest levels since May of this year.

Oil prices plunged to five-month lows as investors and traders reacted to new flash points between the U.S. and China on the trade front and rising tensions between the world’s two biggest economies that could potentially slow energy demand. The U.S. and China are currently battling over rare earth metals needed for advanced technologies.

Encouraging Developments?

Despite the big plunge on Oct. 10, oil prices are recovering alongside stocks on news of some encouraging developments. An expected meeting between U.S. President Donald Trump and Chinese President Xi Jinping later in October has raised hopes for an easing of tensions between the superpowers.

At the same time, Palestinian militant group Hamas has released all remaining Israeli hostages, effectively ending the conflict in Gaza and ratcheting down tensions in the oil-rich Middle East. On the demand side, China’s crude imports in September rose 3.9% from a year earlier to 11.5 million barrels per day, demonstrating continued strength from the world’s biggest energy importer.

Stocks of major oil producers such as Chevron (CVX), Occidental Petroleum (OXY), and Shell (SHEL) are each up on Oct. 13, mirroring the recovery in crude prices.

Is CVX Stock a Buy?

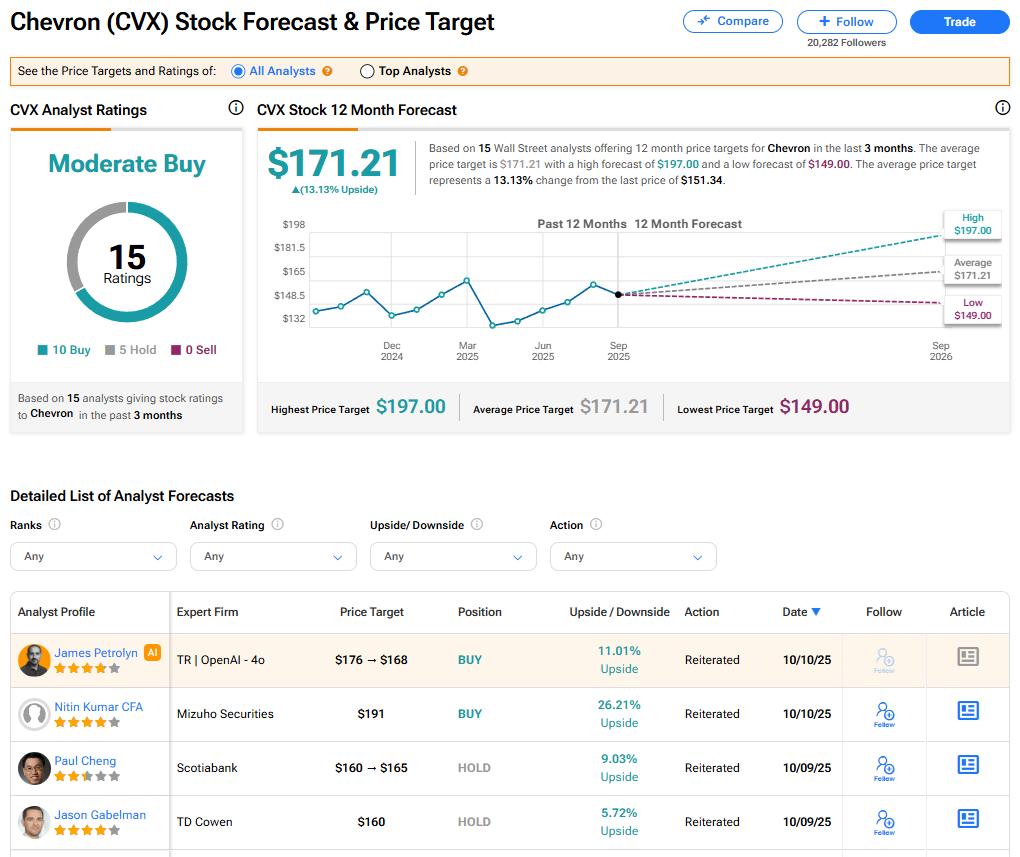

The stock of Chevron has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on 10 Buy and five Hold recommendations issued in the last three months. The average CVX price target of $171.21 implies 13.13% upside from current levels.