The benchmark crude oil WTI (CM:CL) has dropped by nearly 2.42% over the past week as traders dial down geopolitical risks of a wider conflict in the Middle East.

U.S. Crude Stockpiles Decline

Even the latest data from the American Petroleum Institute (API), showing a decline in crude stockpiles, has largely failed to prop up crude prices this week. API numbers pointed to a decrease of 3.23 million barrels in U.S. commercial stockpiles for the week ended April 19.

However, U.S. oil sanctions on Iran and Venezuela, along with Ukraine’s drone attacks on Russian oil assets, could introduce a dose of uncertainty into the mix.

Russia Slashes its Forecast

Meanwhile, Russia has reduced its forecasts for crude oil export prices to $65 per barrel for 2024 to 2027, down from the previous estimate of $71.3 for 2024. The downward revision follows Western sanctions on Russian oil flows and a price cap of $60 per barrel on Russian oil.

What Is the Prediction for Crude Oil?

The next trajectory for oil prices could be determined by the upcoming GDP and inflation numbers later this week. Currently, oil prices have broken out of the upward channel observed over the past four months, suggesting that price weakness could persist for some time.

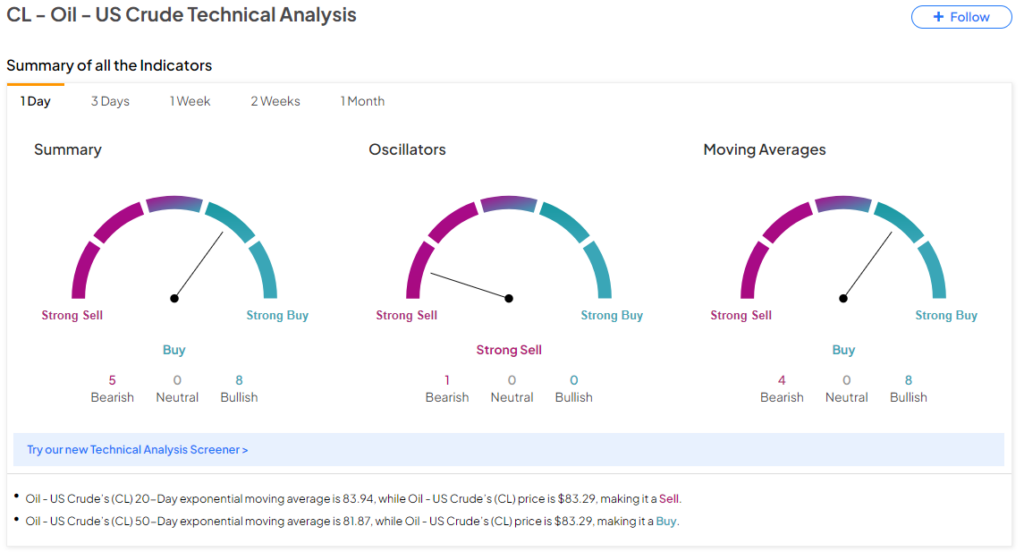

The TipRanks Technical Analysis tool is also flashing mixed signals for oil, indicating that caution may be warranted before initiating fresh long positions.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure