Jensen Huang, the chief executive of American chip design colossus Nvidia (NVDA), believes that the world is already experiencing artificial general intelligence (AGI).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

AGI refers to AI models that are able to understand, learn, and perform any intellectual task that a human can do, moving beyond models that have limited capabilities as they are trained for specific tasks.

Huang’s claim received the backing of Yann LeCun, Meta’s (META) AI leader, and several acclaimed computer scientists, including Geoffrey Hinton and John Hopfield, both of whom jointly won the Nobel Prize in Physics last year for their work on artificial neural networks. These leading AI figures spoke at The Financial Times‘ Future of AI Summit held in London on Wednesday.

According to Huang, sufficient human-level intelligence has already been developed and is already being translated into practical use cases. At the same time, the Nvidia chief believes that the technology holds more potential for the development of several other applications that meet societal needs.

Is Superintelligence Next?

Huang’s comment comes as tech firms are racing to develop AGI — a technology expected to reshape the global economy — with superintelligence as the next goal. However, superintelligence, which refers to artificial intelligence that surpasses human intelligence, has drawn widespread criticism from business executives.

Across the world, businesses have been committing unprecedented investments into AI, raising fears of an AI bubble and a possible stock market crash. Already, research shows that ten unprofitable startups, over the past year alone, have accumulated almost $1 trillion in valuation. At the same time, AI infrastructure spending by tech majors Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta is anticipated to near $400 billion by the end of this year.

Yet, Wall Street tech majors continue to bet on their AI investments, as Microsoft recently tightened its deal with heavyweight AI startup OpenAI (PC:OPAIQ) and Google is now reportedly mulling topping its investment in Anthropic (ANTPQ) in a move that could potentially value the Claude chatbot maker at more than $350 billion.

What Is the Best AI Stock to Buy?

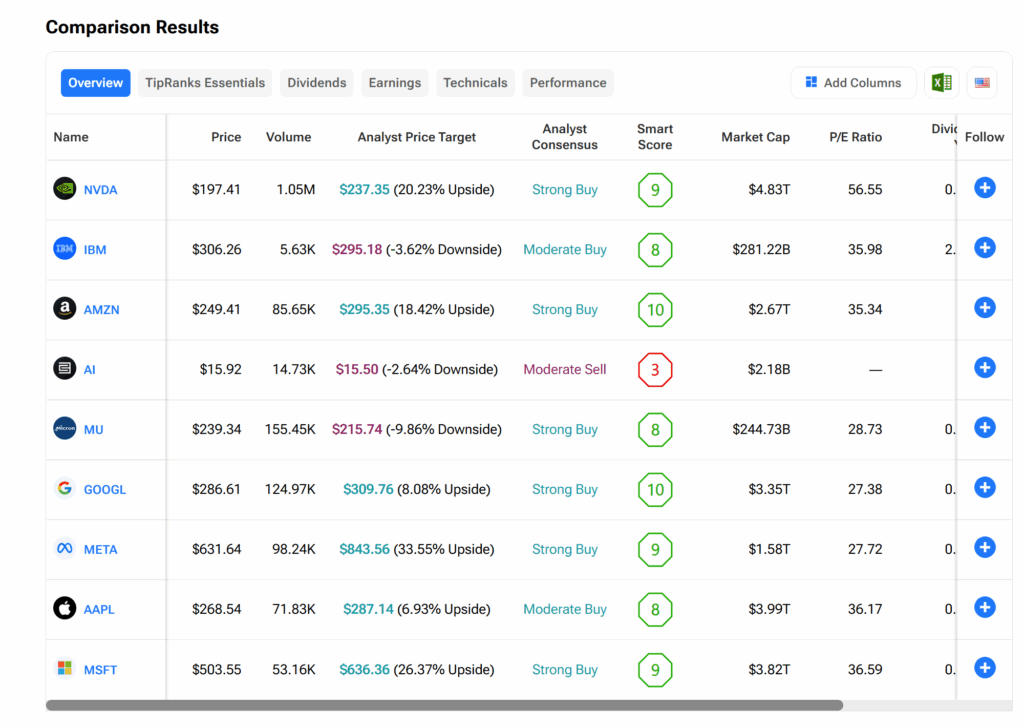

Across Wall Street, analysts are generally bullish on the stocks of companies focused on AI development — as the TipRanks’ Stock Comparison tool image below shows. This comes as recent earnings reports show Big Tech is not slowing down its aggressive capital spending on cloud infrastructure to power the new era of artificial intelligence.