Tech firm Nvidia Corp. (NASDAQ: NVDA) has introduced Quantum Optimized Device Architecture (QODA), a unified programming platform for enabling breakthroughs in quantum research and development in finance, health, HPC (high-performance computing), and AI (artificial intelligence) fields.

The platform creates a hybrid quantum-classical programming model to make quantum computing easily accessible. Experts in the AI and HPC segments can make use of the platform to include quantum computing in existing applications.

Tim Costa, the Director of HPC and Quantum Computing Products at Nvidia, said, “QODA will revolutionize quantum computing by giving developers a powerful and productive programming model.”

At the Q2B conference, which was held in Tokyo on July 12, the Delaware-based company said it is collaborating with several quantum hardware providers for QODA. These quantum hardware companies include Xanadu, Quantinuum, IQM Quantum Computers, Quantum Brilliance, and Pasqal.

The Chief Engineer at Quantinuum, Alex Chernoguzov, said, “Quantinuum is partnering with Nvidia to enable users of Quantinuum’s H-series quantum processors, powered by Honeywell (NASDAQ: HON), to program and develop the next generation of hybrid quantum-classical applications with QODA.”

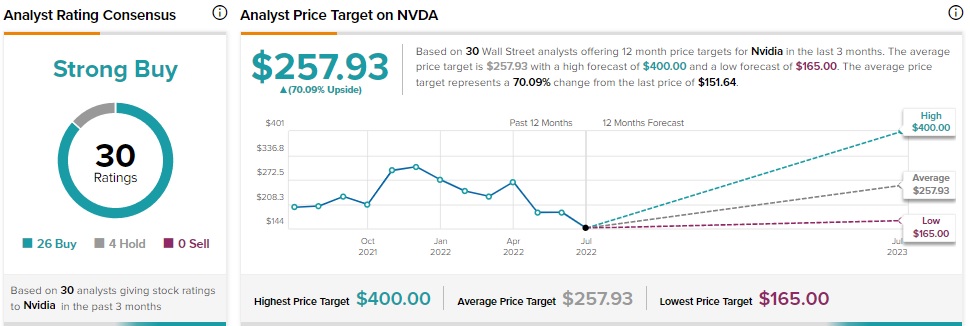

Nvidia Commands a Strong Buy Rating

On July 13, Susquehanna analyst Christopher Rolland maintained a Buy rating on the stock but lowered the price target to $220 from $260 (45.1% upside potential).

Rolland said that the decline in the prices of aftermarket graphic processing units (GPU) was higher than expected because of which he hold a cautious view on the overall personal computer (PC) market for the second half of the year.

Additionally, John Vinh of KeyBanc has reiterated a Buy rating on Nvidia and reduced the price target from $250 to $230 (51.7% upside potential).

In a research note to investors, Vinh said, “Slowing gaming GPU demand due to macro inflationary concerns and a slowdown in crypto mining, and a pushout in the ramp of the RTX40 are likely to result in another cut to forward estimates.”

On TipRanks, the stock has a Strong Buy consensus rating based on 26 Buys and four Holds. NVDA’s average price target of $257.93 implies 70.1% upside potential to current levels.

Hedge Funds Raise Stake in Nvidia

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in Nvidia is currently Very Positive, as the cumulative change in holdings across all 47 hedge funds that were active in the last quarter was an increase of 1.4 million shares.

What’s Next for Nvidia

The tech giant is scheduled to announce its fiscal second-quarter results on August 24. The Street anticipates the company to post earnings of $1.25 per share, higher than the year-ago figure of $1.04 per share.

Nvidia reported upbeat first-quarter results in May. EPS grew 48.6% year-over-year to $1.36, above analysts’ expectations of $1.30.

Read full Disclosure