Chinese cloud companies are rejecting Nvidia’s (NASDAQ:NVDA) chips due to their lower processing power, the Wall Street Journal reported. Notably, Nvidia introduced new products tailored for its Chinese clientele, with reduced processor performance. The changes were made to bypass the enhanced export restrictions on advanced chips by the U.S. Department of Commerce.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per the report, Chinese tech giants such as Alibaba (NYSE:BABA) and Tencent (TCEHY) intend to purchase significantly fewer chips this year compared to their initial plans.

China’s largest cloud companies have been conducting tests on Nvidia’s new samples since November. Consequently, the shift in purchasing behavior of the Chinese tech giants may be linked to the lower processing power of NVDA’s chips. This has minimized the performance gap between NVDA’s chips and locally produced alternatives, making China-made products more appealing to potential buyers.

NVDA’s China Sales to Decline

It’s worth noting that China is an important market for Nvidia. For instance, China and other markets that fall under U.S. export control regulations account for approximately 20% to 25% of NVDA’s Data Center revenue.

To mitigate the challenges, Nvidia expanded its Data Center product portfolio for its Chinese customers. These products do not come under U.S. export control regulations and need no prior licensing. However, the company expects its sales to China and other restricted markets to decline significantly in the fourth quarter. Moreover, with Chinese customers placing fewer orders for its new products, the company’s top line could take a further hit in that region.

Nonetheless, strong growth derived from other markets should enable the company to more than offset the decline in the Chinese market.

Is Nvidia Stock Expected to Rise?

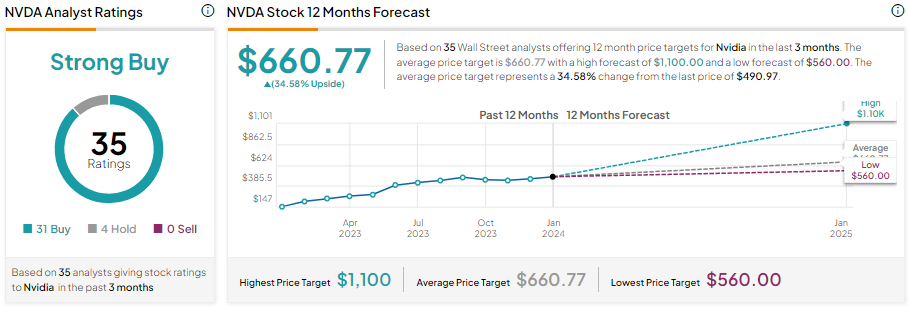

Despite the ongoing U.S.–China chip war, Nvidia stock has gained over 214% over the past year. Moreover, analysts remain upbeat about NVDA’s prospects, given its dominance in the AI (Artificial Intelligence) space.

With 31 Buys and four Hold recommendations, Nvidia stock has a Strong Buy consensus rating. Analysts’ average price target of $660.77 implies it can rise by 34.58% over the next 12 months.