We only heard recently about the potential for damage to chip stocks like Nvidia (NASDAQ:NVDA) as the possibility of new rules about which chips could be sent where emerged. Now, we’ve discovered that the government was proactive and dropped those new rules rapidly. Nvidia, meanwhile, took a hit, down over 3% in Tuesday afternoon’s trading as a result.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Basically, the news was about as bad as feared and possibly worse. Not only was there a new string of rules to be followed about which chips were sent where, but the government promised to be further proactive about things, revisiting the lists “at least” annually to see what else couldn’t be sent where. Commerce Department Secretary Gina Raimondo pointed out that the goal of this initiative was not to hurt the Chinese economy but rather to hamper its development of artificial intelligence and other matters that were “…critical to (Chinese) military applications.”

Not only did the new rules hurt Nvidia directly, but it hurt Nvidia in more ways. The H800, regarded as a “loophole” chip that could be exported under the old rules, was impacted by the new rules, as was the A800. Nvidia was also forbidden from sending chips into more countries. However, the good news here is that as much as it should hurt to lose access to several different markets—including one of the planet’s largest—Nvidia noted that it complies with these regulations fully as-is and looks for no “…near-term meaningful impact” as a result.

What is the Prediction for Nvidia Stock?

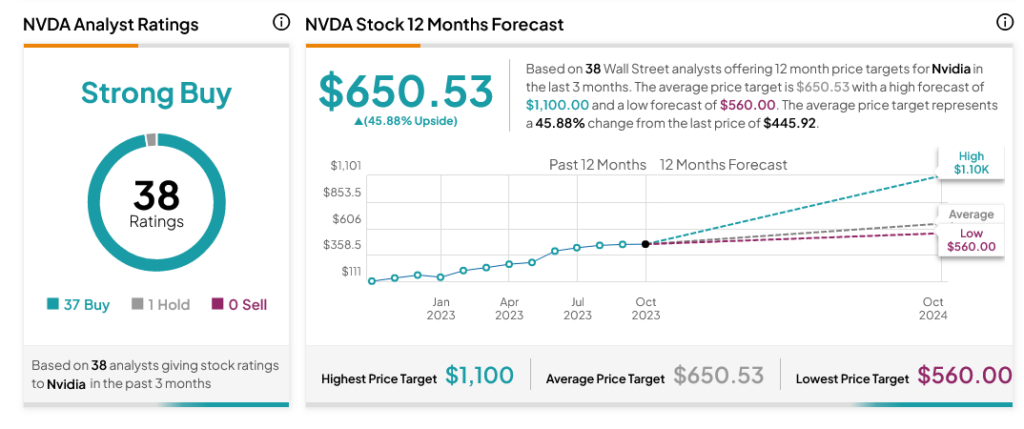

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 37 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $650.53 per share implies 45.88% upside potential.