The Biden administration intends to close a key loophole, which Chinese companies are taking advantage of to secure American artificial intelligence (AI) chips. Last year, the U.S. imposed curbs on the export of AI chips and chipmaking tools to China, citing national security. However, Chinese companies are still able to secure those chips through their overseas subsidiaries, a loophole that the Biden administration plans to close, as per Reuters.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.S. Aims to Make Chip Curbs More Stringent

The U.S. excluded China’s foreign subsidiaries from the chip restrictions imposed previously. Consequently, Chinese companies gained access to the banned AI chips by smuggling them from their foreign subsidiaries into the country. While shipping these restricted AI chips to China is illegal under U.S. law, it is tough for the country to monitor or control such dealings.

Currently, no specific details about what measures the Biden administration is considering to close this loophole are available. However, the U.S. is determined to ensure that China doesn’t get access to the country’s advanced technology and use it to bolster its AI capabilities and military advancements.

In August, the U.S. expanded its curbs on exports of advanced chips of Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) to certain countries in the Middle East. Nvidia has previously argued that U.S. restrictions prohibiting the sale of advanced GPUs to China will result in a “permanent loss” of an opportunity for American semiconductor companies to lead a lucrative market.

Nonetheless, Nvidia continues to dominate the chip market and deliver robust sales, thanks to the generative AI boom. While AMD is also focusing on capturing the demand for AI chips, the company has been under pressure over recent quarters due to the weakness in the PC market.

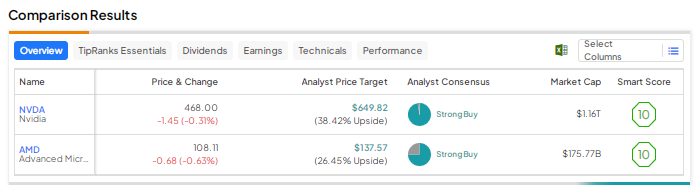

Let’s take a look at Wall Street’s ratings for these two chip giants.

Wall Street is bullish on both Nvidia and Advanced Micro Devices, with the respective average price target implying an upside of 38.4% and 26.5%. As per TipRanks’ Stock Comparison Tool, both stocks earn a “Perfect 10” score, implying they could outperform the broader market over the long run. Shares of NVDA have rallied by an impressive 221% year-to-date, while AMD stock is up about 86%.