AI chipmaker Nvidia (NVDA) continues to dominate headlines, riding strong momentum in 2025 as AI innovation and strategic partnerships fuel growth. Meanwhile, TipRanks A.I. Stock Analysis has backed Wall Street’s bullish outlook on NVDA stock, signaling confidence in the company’s long-term potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks based on key performance metrics, giving investors a clear and concise snapshot of a stock’s potential.

Nvidia Earns Outperform Rating

According to TipRanks A.I. Stock Analysis, Nvidia earns a solid score of 81 out of 100 with an Outperform rating. The analysis pegs Nvidia’s stock price forecast at $204, signaling more than 14% upside from the current level. Additionally, the tool highlights both the positive and negative factors influencing the company’s stock performance.

Among the positive factors, Nvidia is strategically positioned in the AI infrastructure space, giving it significant long-term growth potential as global AI spending is expected to surge by the end of the decade. Moreover, the company’s record revenue of $46.7 billion reflects strong demand across its platforms. Below is the screenshot for reference.

On the bearish side, Nvidia faces several challenges that could affect its growth. Geopolitical tensions, especially in China, may limit the company’s ability to operate and expand in key markets. Rising operating expenses could put pressure on margins and profitability, potentially restricting financial flexibility and investment in growth initiatives.

Wall Street also Stays Bullish on NVDA

Earlier this week, Nvidia announced a major partnership with OpenAI, with Nvidia set to invest up to $100 billion in the AI company. The deal involves using at least 10 gigawatts of Nvidia systems to build OpenAI’s infrastructure, powering the training and operation of its most advanced AI models.

Following this, NVDA stock has attracted bullish attention from Wall Street analysts, with many raising their price targets. For instance, Barclays’ five-star-rated analyst Thomas O’Malley raised his price target from $170 to $200, signaling about 9% upside. He called the partnership a “compute bonanza,” pointing to huge growth potential in AI computing.

Likewise, Evercore’s top-rated analyst Mark Lipacis also reiterated a Buy rating and lifted the price target from $214 to $225, implying roughly 22.5% upside. He named Nvidia a “Top Pick,” highlighting its position as a leading AI investment.

What Is the Price Target for Nvidia Stock?

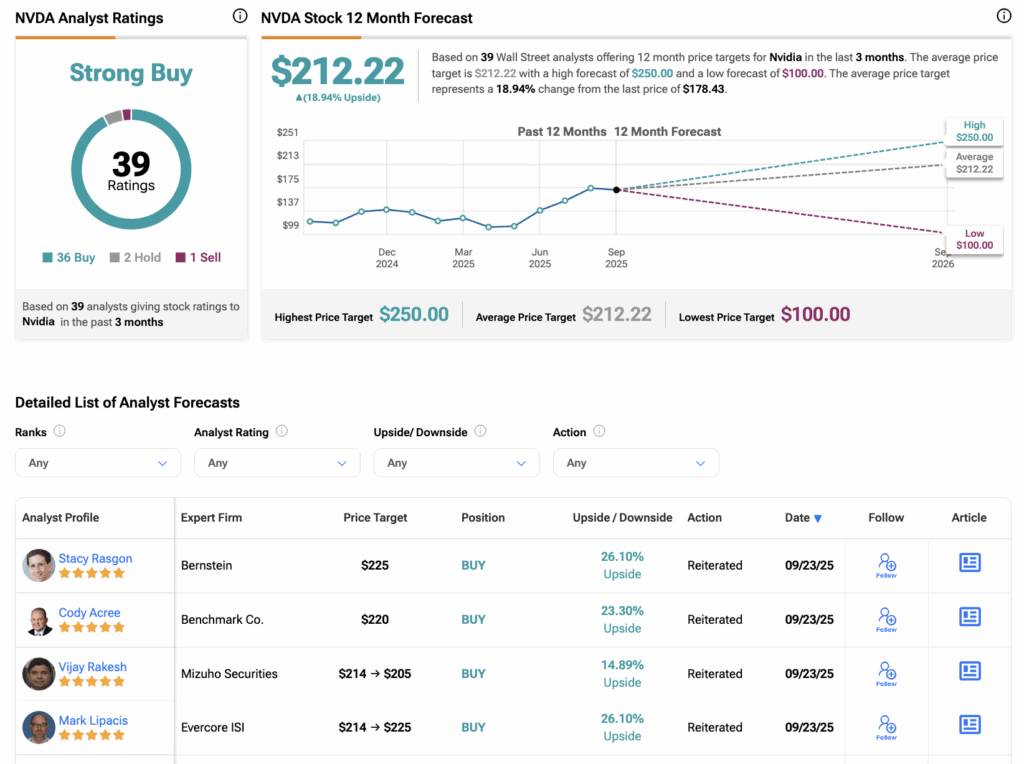

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 36 Buys, two Holds, and one Sell assigned in the last three months. At $212.22, the Nvidia average share price target implies a 19% upside potential.

Year-to-date, NVDA stock has gained 33%.