Wall Street is buzzing after Nvidia (NVDA) secured a $100 billion data center deal with OpenAI. Nvidia will invest up to $100 billion in OpenAI as they deploy at least 10 gigawatts of Nvidia systems to power OpenAI’s next-generation AI models. The news prompted two top analysts to lift their NVDA price targets, citing strong catalysts from the partnership.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Barclays analyst Thomas O’Malley maintained his Buy rating on NVDA and lifted his price target from $170 to $200, implying 8.9% upside potential. O’Malley called the agreement a “compute bonanza,” referring to the enormous growth potential in AI computing.

Simultaneously, Evercore ISI analyst Mark Lipacis reiterated his Buy rating and raised the price target from $214 to $225, implying 22.5% upside potential. He labeled Nvidia a “Top Pick,” highlighting its role as the leading AI investment.

Barclays Sees a Compute Bonanza

O’Malley compared Nvidia’s deal with rival Broadcom’s (AVGO) recent $10 billion agreement with OpenAI to supply custom silicon. Despite growing demand for custom silicon, he believes general-purpose chips will still handle most of OpenAI’s workloads through at least the 2030s, keeping them highly relevant.

From Nvidia’s Q2 earnings, he estimated that 1GW of computing power equals more than $35 billion in revenue for the company. Hence, O’Malley argues that the market is likely undervaluing this impact, as the deal is incremental and could boost Nvidia’s earnings by $35 billion.

O’Malley is a five-star analyst on TipRanks, ranking #213 out of 10,050 analysts tracked. He has a 60% success rate and an average return per rating of 24.10%.

Nvidia Remains a Top Pick for Evercore

After discussions with Nvidia’s CFO, Lipacis expressed stronger confidence that Nvidia is the leading choice in the AI ecosystem and that Wall Street’s earnings estimates are “too low.”

He added that Nvidia is the preferred supplier to OpenAI, which initially underestimated demand for Nvidia’s solutions but now aims to secure supply ahead of surging needs. Lipacis believes Nvidia is “uniquely positioned” to support OpenAI’s large-scale infrastructure expansion.

Lipacis is also a five-star analyst on TipRanks, holding the #53 spot. He boasts a 66% success rate and an impressive average return per rating of 26.50%.

Is It Too Late to Invest in Nvidia?

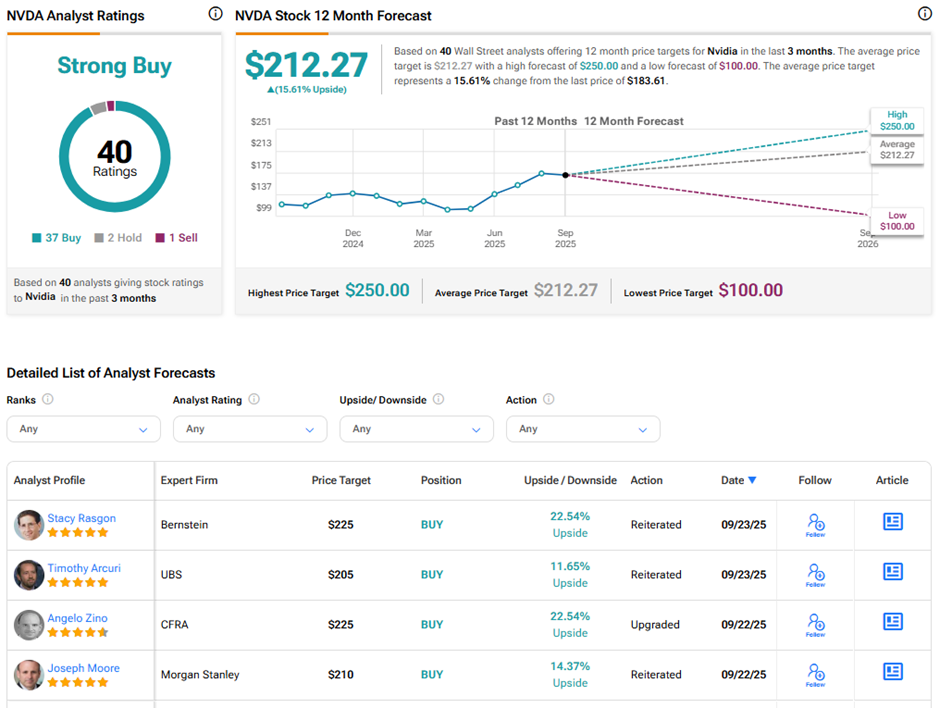

Despite climbing more than 36% year-to-date, analysts see further upside in Nvidia’s shares. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 37 Buys, two Holds, and one Sell rating. The average Nvidia price target of $212.27 implies 15.6% upside potential from current levels.