Nvidia (NASDAQ:NVDA) will release its first quarter Fiscal 2025 financials after the market closes on Wednesday, May 22. Wall Street analysts remain upbeat and expect the chip maker to deliver stellar sales and earnings growth in Q1. However, individual investors have a Negative view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock decreased by 1.4%. This suggests that these investors have booked profits ahead of the Q1 print.

Overall, among the 735,028 portfolios monitored by TipRanks, 18.8% have invested in NVDA stock.

Q1 Projections Suggest Strong Growth

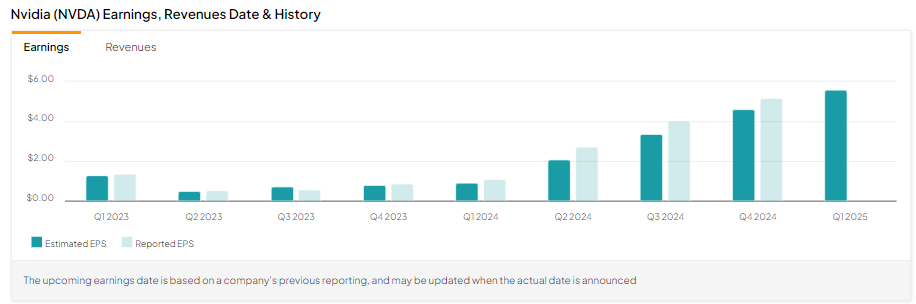

Analysts expect Nvidia to post revenue of $24.59 billion in Q1, implying its top line could more than triple year-over-year. Moreover, Wall Street expects NVDA to post earnings of $5.60 per share in Q1, up about 414% year-over-year.

It’s worth noting that Nvidia has beaten earnings estimates every quarter since its fourth quarter of Fiscal 2023. However, merely a beat will not push NVDA stock higher. The magnitude of the quarterly earnings beat will primarily determine the future direction of NVDA stock.

Is Nvidia a Buy or Sell?

Nvidia stock is a buy ahead of Q1 earnings based on analysts’ consensus rating. It has 40 Buy and two Hold recommendations for a Strong Buy consensus rating. The analysts’ average NVDA stock price target of $1,057.76 implies 10.89% upside potential from current levels.