Chipmaker Nvidia (NVDA) has quietly become a major player in the startup world, even though it’s not a venture capital firm. Recently, the company announced plans to invest $100 billion in OpenAI (PC:OPAIQ), a record-breaking amount if the deal goes through. This is just one of many investments Nvidia has made in artificial intelligence startups around the globe. Indeed, at its GTC event in Washington, CEO Jensen Huang proudly named several companies Nvidia has backed, including AI search engine Perplexity, Chinese autonomous driving firm WeRide (WRD), and robotics startup Figure AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, it is worth noting that Nvidia’s backing of startups is accelerating quickly. In fact, it had already invested in 59 AI startups this year as of mid-October. This is more than the 55 it funded in all of 2024 and a huge jump from just 12 in 2022, according to PitchBook. Huang says that the goal is to grow the AI ecosystem, which will help create new uses for Nvidia’s chips. Analysts say that by helping AI companies grow, Nvidia strengthens its grip on the industry, thereby making it harder for competitors to replace it.

In addition, startups benefit not only from Nvidia’s money but also from direct access to its leadership and high-powered computing resources. For example, Perplexity’s CEO said a request for technical help was approved by Huang and resolved within minutes. For reference, this would have normally taken days at other companies. Nvidia’s investment strategy also helps it diversify from large tech companies, as major players like Anthropic (PC:ANTPQ) are turning to Google (GOOGL) in order to reduce their reliance on Nvidia.

What Is a Good Price for NVDA?

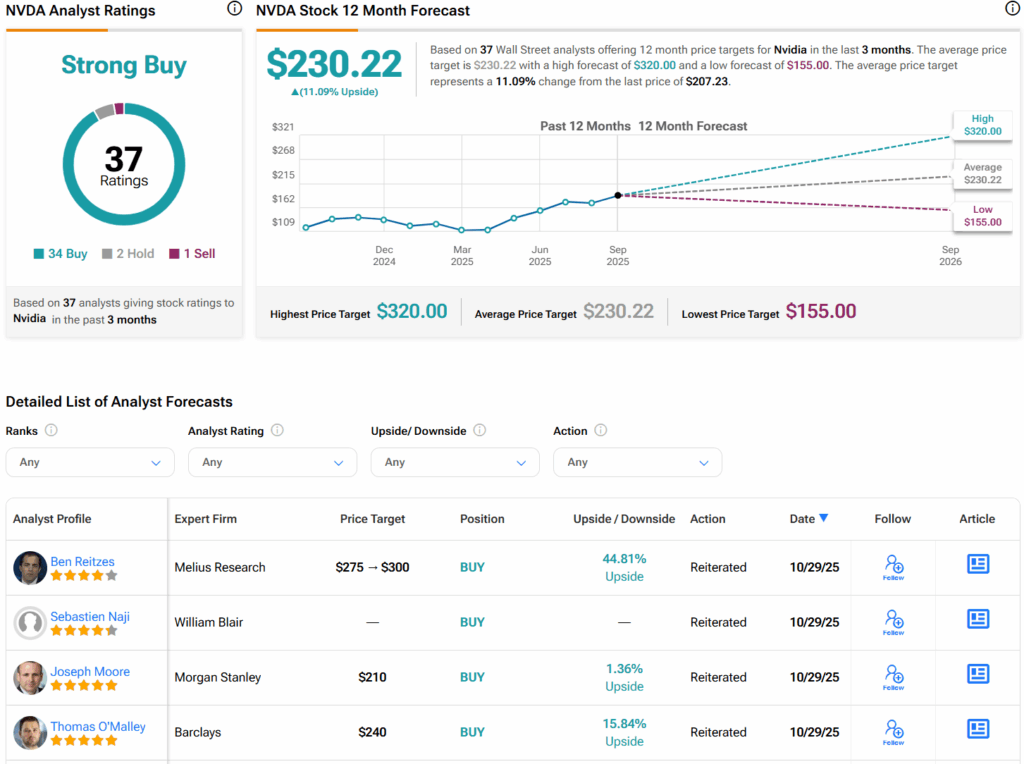

Turning to Wall Street, analysts have a Strong Buy consensus rating on Nvidia stock based on 34 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average Nvidia price target of $230.22 per share implies 11.1% upside potential.