Yesterday, tech giant Google (GOOGL) announced a major deal to supply AI firm Anthropic (PC:ANTPQ) with up to one million of its in-house Ironwood TPUs, which are custom chips that are built specifically for artificial intelligence. As a result, HSBC (HSBC) believes that this move could lead to more similar deals in the future. And since the TPUs are developed by Google itself, rather than purchased from another company, the bank expects higher profit margins from renting them out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, HSBC analyst Paul Rossington also noted that among Western cloud providers, Google is the only one that managed to get a next-gen in-house chip into production in 2025. In contrast, Microsoft’s (MSFT) Braga chip and Amazon’s (AMZN) Trainium3 are delayed until 2026. Rossington sees this as a major reason behind the Anthropic deal and a sign that other companies may choose Ironwood in the near future as well.

Moreover, the bank estimates that renting out these TPUs for three years could bring in $1.50 to $2.00 per hour, which would generate $13.1 billion to $17.5 billion in revenue from just 1 gigawatt of capacity. This led HSBC to raise its forecast for Google Cloud’s 2026 revenue by $10 billion and increase its stock price target from $285 to $295.

Is Google Stock a Good Buy?

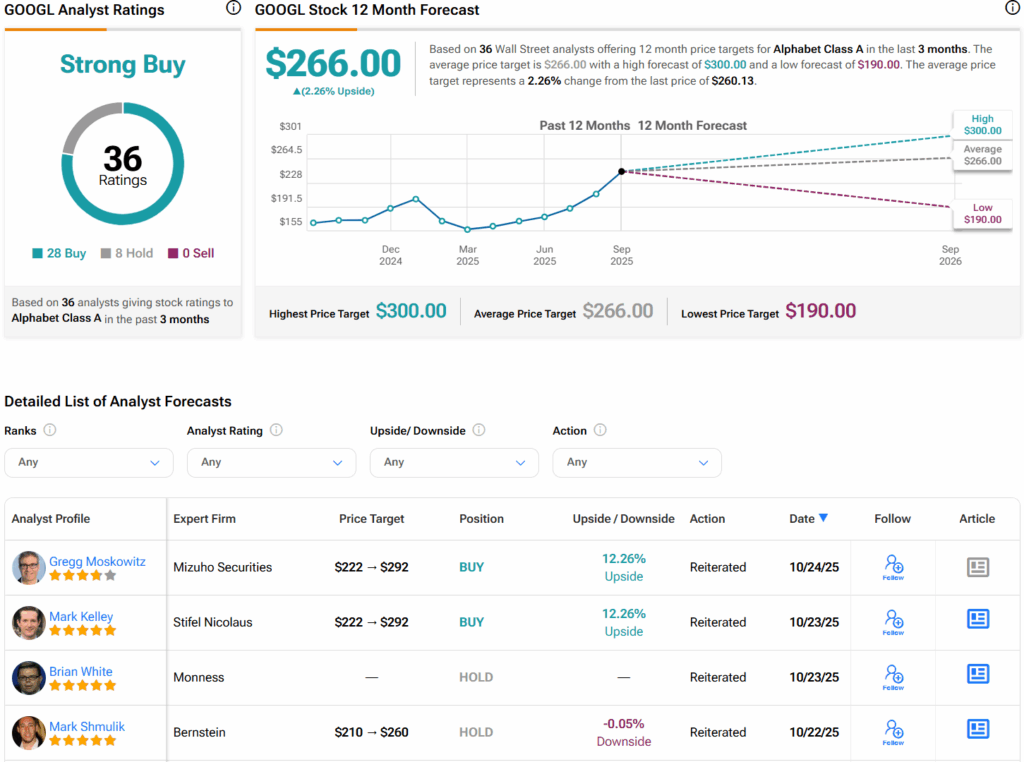

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and eight Holds assigned in the past three months. Furthermore, the average GOOGL price target of $266 per share implies that shares are trading near fair value.