Nvidia (NVDA) and Palantir Technologies (PLTR) have been standout leaders in the bull market over the past few years. The gains have been remarkable. Over the past five years, PLTR stock has jumped more than 1,800%, while Nvidia is up over 1,300%. Demand continues to stay high in 2025, as both stocks have kept rising year-to-date despite their already huge gains. Naturally, investors are wondering whether the rally has gone too far, and whether it is too late to buy?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia leads the AI hardware space, providing technology for data centers and autonomous cars. Meanwhile, Palantir focuses on AI software for government and business clients. For investors looking to ride the AI wave over the long term, both offer strong opportunities, but in different ways. Here’s a closer look.

Nvidia (NASDAQ:NVDA)

Nvidia’s stock has climbed roughly 36% year-to-date, recovering amid setbacks caused by tariff issues and chip export limits. After July, the rally accelerated as Nvidia became the first company to surpass a $4 trillion market value.

Looking ahead, the AI boom shows no signs of slowing, and Nvidia is still growing rapidly despite its massive size. Demand for GPUs (graphics processing units) remains strong even after three years of explosive growth, and it looks set to increase as hyperscalers race to develop advanced AI.

Just last week, Nvidia announced a major partnership with OpenAI to deploy at least 10 gigawatts of Nvidia systems for OpenAI’s next-generation AI infrastructure, involving millions of GPUs. Nvidia will gradually invest up to $100 billion as each gigawatt comes online, with the first deployment scheduled for the Vera Rubin platform in the second half of 2026.

Is Nvidia Still a Good Stock to Buy?

NVDA stock also remains a favorite among Wall Street analysts, with many maintaining strong buy ratings and bullish price targets.

Most recently, five-star-rated analyst Thomas O’Malley at Barclays raised his price target on NVDA stock from $200 to $240, signaling a potential upside of 35% from current levels. O’Malley expects Nvidia to be the main winner from more than $2 trillion in planned AI infrastructure investments. He stated that much of this AI spending is to flow directly into Nvidia’s profits over the next five-plus years, significantly boosting its numbers and making it the most attractive stock in this space.

Palantir Technologies (NASDAQ:PLTR)

PLTR stock has jumped over 130% so far in 2025, fueled by growing AI use, rising global tensions, and higher defense spending. The company is a major defense technology partner, earning most of its revenue from U.S. government contracts, particularly the Department of Defense.

However, Palantir’s rich valuation raises doubts about whether its price matches its growth prospects. Notably, the company has a P/E ratio of 590 versus the sector average of 30.9. Even so, many investors overlook the premium, banking on its strong U.S. government ties and a rapidly growing, high-margin commercial arm. In Q2 2025, Palantir’s U.S. commercial revenue soared 93% year over year, rising to 31% of total sales, while overall revenue topped $1 billion for the first time.

Looking ahead, Palantir now projects revenue of $4.14 billion to $4.15 billion for 2025, up from its earlier forecast of about $3.89 billion to $3.90 billion.

Is PLTR Stock a Good Buy Now?

Despite Palantir’s strong momentum, most analysts remain cautious, with the majority still rating the stock a Hold.

Even so, there are bullish voices. Last week, Bank of America’s five-star-rated analyst Mariana Perez Mora raised her price target on PLTR from $180 to a Street-high of $215, signaling more than 20% upside. Mora cited the company’s solid government business and faster growth in its data analytics platforms as key drivers.

She also highlighted a new five-year military AI contract worth up to £750 million from the U.K. Ministry of Defence, signaling growing international demand. She now projects Palantir’s government sales to surpass $8 billion by 2030, implying an estimated 30% compound annual growth rate (CAGR) from 2025 to 2030.

NVDA or PLTR: Which Stock Offers Higher Upside, According to Analysts?

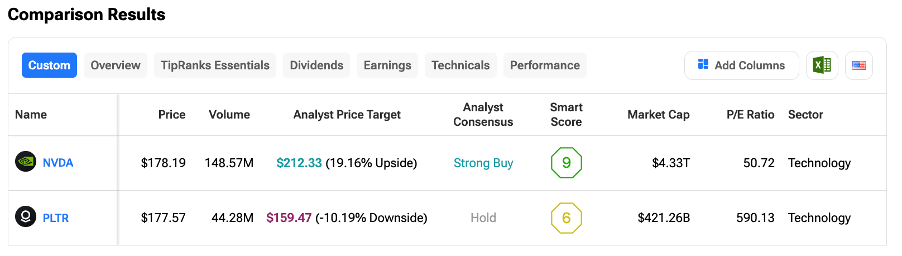

Using TipRanks’ Stock Comparison Tool, we have compared NVDA and PLTR to see which stock offers higher upside to investors. Nvidia stock currently holds a Strong Buy rating, with an average price target of $212.33, implying an upside of 19.16% from current levels.

On the other hand, PLTR stock carries a Hold consensus among 19 analysts. Palantir’s average stock price target of $159.47 suggests a downside of over 10%.

Conclusion

Nvidia and Palantir have clearly been the standout stocks of this bull market, and their momentum shows no signs of slowing. Both continue to benefit from strong long-term trends that draw investor interest. The challenge now is timing. After huge gains over the past three years and further rallies in 2025, their high valuations leave little room for mistakes.

Analysts currently favor NVDA, which holds a Strong Buy rating and an estimated 19% upside from current levels.