Any investor is constantly on the lookout for the next big thing. For the past year that has been Generative AI, with Nvidia (NASDAQ:NVDA) spearheading the advance and its share price skyrocketing higher due to its leading position as the chipmaker of choice for the industry.

For those regretting not seizing the chance to invest in NVDA before its meteoric rise, there may still be hope. According to one market watcher, the next promising investment opportunity might be closer than they think.

5-star investor Victor Dergunov thinks Advanced Micro Devices (NASDAQ:AMD) could be on the cusp of a big surge, believing an “Nvidia moment is likely near.”

While Nvidia has so far cornered the market for AI chips, AMD is often viewed as sort of its little brother and possibly the one company that can give it a run for its money in the AI chip space, and that is a sentiment shared by Dergunov.

“It seems we may be underestimating the magnitude of the AI market and AMD’s potential in the space,” Dergunov says. “AI is already becoming a formidable industry, and it may only be in the beginning phase.”

That is no idle claim. According to Statista, the AI market is expected to grow from around $300 billion this year to ~$1.85 trillion by 2030, and given the company’s high-quality offerings such as its new MI300 Series accelerators, AMD could have a “considerable portion of the pie.”

Beyond that point, the market could continue expanding, potentially reaching “epic proportions like the internet and other revolutionary industries.” That means there’s plenty of growth for AMD to tap into and Dergunov points out that once the AI demand “translates to the bottom line,” the company will provide significantly increased revenue and EPS guides.

“Increasing demand and revenues for its server accelerator processors and other advanced GPU/CPU hardware should enable AMD’s Nvidia moment to occur,” notes Dergunov. “This dynamic should allow AMD’s stock to move much higher, and we’re around an excellent buy-in spot right now.” Accordingly, Dergunov rates AMD stock a Strong Buy. (To watch Dergunov’s track record, click here)

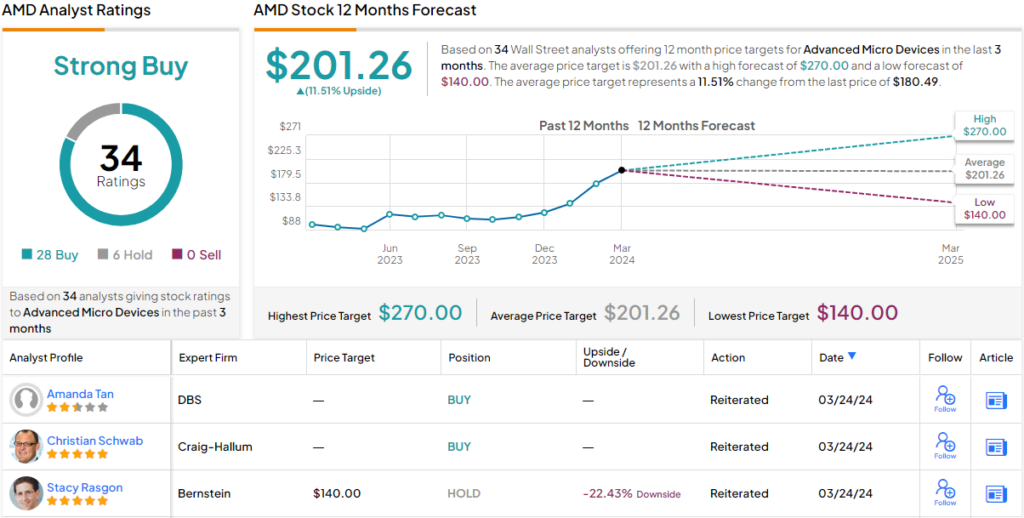

A Strong Buy is also the conclusion reached by Wall Street’s analyst consensus, a rating based on 28 Buys and 6 Holds. The average price target currently stands at $201.26, and factors in 12-month returns of 11.5%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.