Nvidia (NVDA) continues to stand out as one of the strongest long-term performers in the U.S. market. According to independent investment firm Creative Planning, the chipmaker has been the best-performing stock in the S&P 500 over the past 10, 15, and 20 years. In addition, it ranks third over the last five years, showing its steady record of beating the market. Amid this strong track record, Wall Street remains optimistic about Nvidia’s outlook, citing sustained demand for its AI chips and the company’s growing influence in the global semiconductor industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In terms of share price, NVDA stock has rallied 40% year-to-date and is up 47% over the past 12 months.

AI Boom Lifts Nvidia’s Valuation

Nvidia’s gains have accelerated since the AI boom began in late 2022. Since then, its market value has jumped from $418 billion to $4.56 trillion, helped by strong demand for its advanced chips that power AI systems in many sectors.

Creative Planning’s Chief Market Strategist Charlie Bilello noted that Nvidia’s total return has climbed 1,341% over five years, 31,025% over ten years, 72,005% over fifteen years, and 69,610% over twenty years. Other tech giants like Tesla (TSLA) and Apple (AAPL) also appear among the top five, though both still trail Nvidia’s long-term gains.

Top Analyst Maintains Positive View

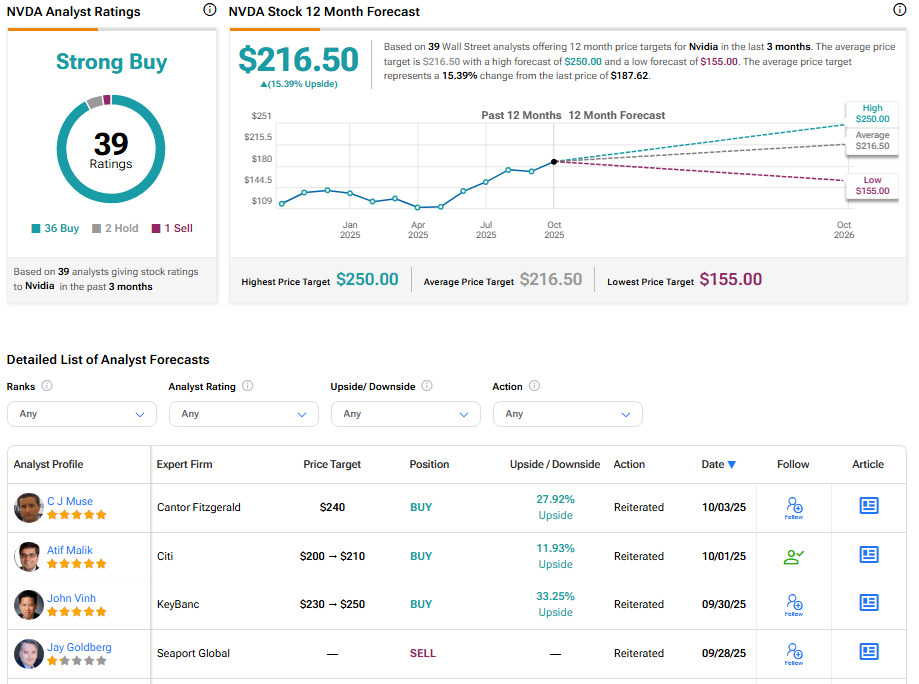

Last week, Cantor Fitzgerald analyst C.J. Muse reiterated a Buy rating on Nvidia with a price target of $240, implying a 28% potential upside. Muse ranks No. 84 among more than 10,000 analysts on TipRanks. He has a success rate of 71%, with an average return per rating of 34.1% over a one-year period.

The five-star analyst pointed to the company’s growing role in AI infrastructure and its recent $100 billion investment in OpenAI (PC:OPAIQ) as key reasons for his optimism. He said the company is well placed to benefit as spending on AI systems continues to rise worldwide.

Is Nvidia Stock a Buy Right Now?

Wall Street has a Strong Buy consensus rating on the stock based on 36 Buys, two Holds, and one Sell recommendation. The average NVDA stock price target of $216.50 indicates 15.39% upside potential.