The world runs on silicon semiconductor chips, and those chips are subject to boom and bust cycles. According to some industry experts, however, we may be at the very beginning of a long-term ‘super cycle’ boom for chips.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The rise in AI technology, and generative AI in particular, has fueled an insatiable demand for more powerful and efficient semiconductor chips. AI is rapidly expanding to all sorts of technological applications, and it’s not just a chip-heavy tech; it’s a high-end chip-heavy tech. Existing inventories, based on older chip designs, are not sufficient to meet the growing demands of the future, especially if AI is to be more fully integrated into a wider range of products and industries.

According to Mizuho’s Vijay Rakesh, an analyst ranked in the top 1% of Street experts, these facts present a solid reason for buying into chip stocks now. Rakesh has tapped Nvidia (NASDAQ:NVDA) and Intel (NASDAQ:INTC) as his choices for the best chip stocks to buy going forward. Let’s see why.

Nvidia

First on our list is Nvidia, a world leader in the semiconductor industry, one of the ‘Magnificent 7’ tech stocks that powered last year’s markets gains, and – with its $1.3 trillion market cap – the fifth largest publicly traded firm in the world.

Prior to the AI boom, Nvidia boasted a market share of nearly 80% in the chip-intensive, highly lucrative, data center segment; since November of 2022, when generative AI hit the scene, Nvidia has boomed. Its data center market share has slipped, but its graphic processor units, originally designed for professional graphic design work and/or high-end gaming, proved to have the speed and capacity needed to power AI systems, and demand for the company’s products spiked.

Nvidia’s chip lines offer solutions for a wide range of industries. The company is prominently represented in the data center industry, where it is estimated to currently have a 70% market share. Nvidia’s data center business made up 80% of the company’s 3Q23 revenue (the most recent reported quarter), coming in at $14.51 billion. This marked a 41% sequential gain for the segment, and a 279% year-over-year increase.

During Q3, Nvidia’s gaming segment played a vital role in the company’s operations, generating $2.86 billion in revenue. Notably, gaming revenues witnessed an impressive 81% year-over-year increase.

Overall, Nvidia’s solid positions in multiple markets – including data centers, gaming, professional graphic design and home studios, AI applications, and the automotive industry – powered the company to a solid result in 3Q23. The top line was $18.12 billion, a company record, up 206% y/y, and $2 billion better than had been expected. The company’s bottom line was highly profitable; at $4.02 per share, the non-GAAP EPS was up by a factor of 6 y/y, and beat the forecast by 63 cents per share.

For Mizuho’s Rakesh, all of this adds up to a stock worth buying. The 5-star analyst makes particular reference to Nvidia’s solid AI and data center business, writing, “We see NVDA remaining the leader in the AI training and inference chips for Data Center applications (we estimate >95% share), which we believe is growing at a 74% CAGR to ~$400B by 2027E. Gaming GPUs (we estimate >75% PC share) are expected to remain healthy and stable, while NVDA’s automotive ADAS pipeline remains strong. We continue to see NVDA executing its roadmap, with GH200 and H200 ramping in 2024E, as well as increasing its AI server content via the Grace CPU.”

Rakesh goes onto explain in further detail why Nvidia should keep bringing gains for investors, adding, “We believe its RTX 40-series penetration remains at ~10% of the PC market, implying a significant upgrade cycle opportunity ahead in 2024 for the RTX 50-series as NVDA could see a >$10B/yr Gaming revenue run rate.”

These comments back up the analyst’s Buy rating on NVDA, and his $625 price target points toward a one-year upside of 19%. (To watch Rakesh’s track record, click here)

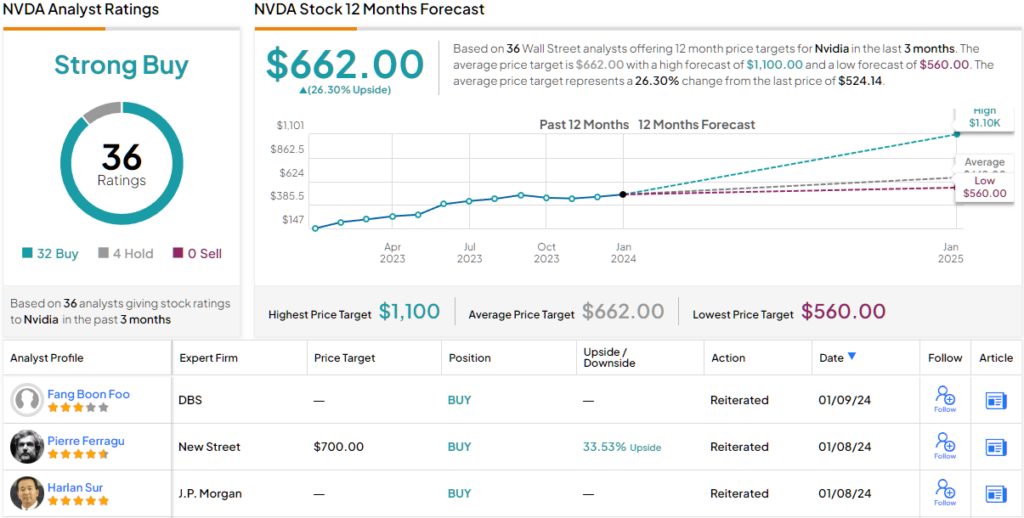

Overall, NVDA has picked up 35 recent reviews from Wall Street’s analysts, and those break down 32 to 4 in favor of Buys over Holds – for a Strong Buy consensus rating. Shares in NVDA are trading for $523.49, and their $662 average target price suggests that a 26% appreciation lies on the horizon. (See Nvidia stock forecast)

Intel

Not too long ago, Intel stood as the world’s leading chip manufacturer. However, in recent years, the company’s fortunes have taken a downturn. In 2023, during a period of significant growth in the semiconductor industry driven by AI, Intel found itself without a competitive AI-capable chip in the market. While Intel remains a successful company, relying primarily on its legacy business in PCs and other computing devices, it has lost ground compared to its industry peers.

However, Intel has no intention of being left behind, and it is expanding its business in the important data center and AI segments. This past December, Intel announced several new chip products, including the Gaudi3 designed for generative AI software; the fifth-gen Xeon server chips; and the new Core Ultra chips for Windows PCs and laptops.

When we turn to Intel’s recent financial results, last released for 3Q23, we find that the company’s leading segment was its client computing group, which brought in $7.9 billion in revenue. This was followed by the data center and AI business, responsible for $3.8 billion of the firm’s sales. Overall, Intel’s Q3 top line was $14.2 billion. While down 8% year-over-year, this result beat expectations by a solid margin of $560 million. On earnings, Intel reported a non-GAAP EPS of $0.41, or some 19 cents per share above the forecast.

We should note here that Intel’s shares have gained 67% in the last 12 months, which, while not as impressive as Nvidia’s 236% one-year gain, still strongly outpaces the 39% increase seen on the NASDAQ index in the same period.

Turning again to Mizuho analyst Rakesh, we find the tech-sector expert pointing out Intel’s strong efforts to ‘close the gap’ with its competitors in the data center and AI areas – and pointing out those efforts as attractive for investors.

“After its most recent Emerald Rapids and Meteor Lake releases, we believe INTC is positioned better into 2024E with multiple launches including 288-core Sierra Forest and 96-core Granite Rapids which could close the Datacenter gap to AMD and Arrow Lake on 20A for PCs in 2H24E. In AI, INTC announced Gaudi 3 which could position it well for upside to INTC’s $2B AI revenue target for F23E, with its software platform, oneAPI, growing in development maturity. While IFS remains a 2025E story, announcements of customers in 2024E could be positive and continue solid roadmap execution could be near-term benefits,” Rakesh opined.

Rakesh goes on to quantify his positive stance on INTC with a Buy rating and a $58 price target. His target suggests a 21% share gain for the stock in the next 12 months.

While the Mizuho view is bullish here, the Street generally is more cautious, and not quite ready to buy in. INTC shares get a Hold consensus rating, based on 31 recent reviews that include 8 to Buy, 20 to Hold, and 3 to Sell. The stock is selling for $47.92 and its $44.33 average price target predicts a 7.5% downside for the coming year. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.