Just when you thought AI was taking over the world, consultancy Bain has come along to burst the bubble of tech giants such as Nvidia (NVDA) and Microsoft (MSFT).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Financial Gap

In a new report, Bain has warned that companies investing hundreds of billions of dollars in data centers may face a significant financial shortfall in the coming years.

It has found that by 2030 AI companies will need $2 trillion in combined annual revenue to fund the computing power needed to meet projected demand. However, its annual Global Technology Report states that their revenue is likely to fall $800 billion short of that mark as efforts to monetize services such as ChatGPT trail the spending requirements for data centers and related infrastructure.

The report comes just after semiconductor giant Nvidia announced the decision to invest up to $100B in OpenAI to promote deployments of data centers and power capacity, which includes a letter of intent for Nvidia to be involved in at least 10 GW of systems.

OpenAI, along with Oracle (ORCL) and SoftBank (SFTBY) is also part of the Stargate Project. It plans to invest up to $100 billion in data center infrastructure during its initial phase, with an aim to invest a total of $500 billion over the next four years.

Microsoft recently announced plans to build a second AI data center in Wisconsin, bringing its spending in the state on data centers to $7 billion.

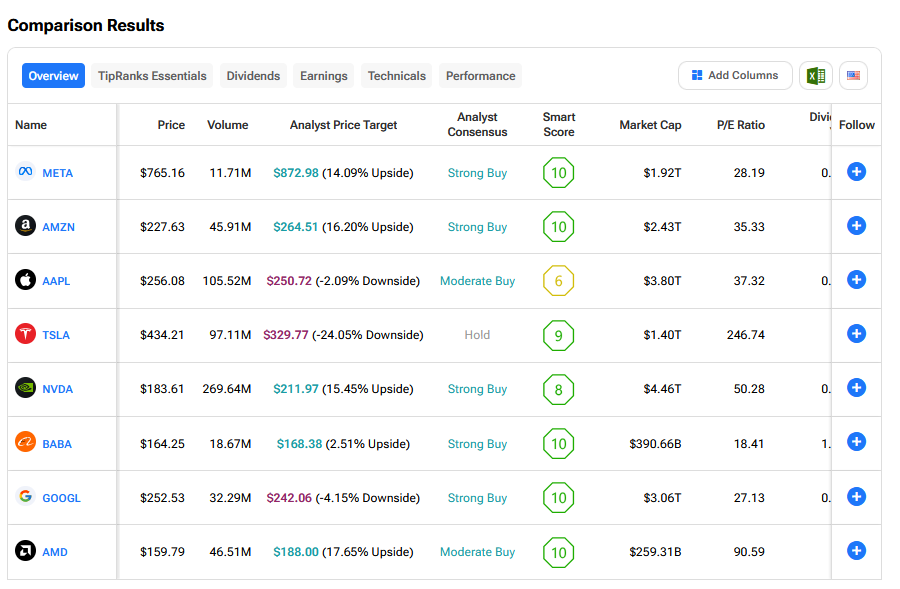

Such moves have helped lift the share prices of tech firms this year – see above- but Bain’s findings will raise some doubts about the finances behind these bold ambitions.

“If the current scaling laws hold, AI will increasingly strain supply chains globally,” said David Crawford, chairman of Bain’s global technology practice.

Regional Champions

Global incremental AI computing requirements could soar to 200 gigawatts by 2030, with the US accounting for half that, Bain said. While breakthroughs in technology and algorithms could ease the burden, supply chain constraints or insufficient power supply could thwart the progress.

It also raised concerns about the relations between the U.S. and China as they compete for AI leadership.

It said that export controls, investment restrictions, and sanctions are leading tech companies to reconfigure global strategies and confront uncertain access to key markets.

“As China’s firms accelerate domestic alternatives and US firms shift manufacturing, the resulting decoupling could reshuffle global tech leadership, with regional champions replacing global incumbents,” it said.

There is also a risk for tech leaders in the rise of quantum computing. “As governments and companies race to develop quantum advantage, the first movers could leapfrog current tech giants in sectors from cloud to cybersecurity,” Bain said.

“The uncertainty around when scalable quantum breakthroughs will occur leaves incumbents exposed to disruption from start-ups or state-backed programs with early breakthroughs.”

What are the Best AI Stocks to Buy Now?

We have rounded up the best AI stocks to buy now using our TipRanks comparison tool.