A class action lawsuit was filed against Nutex Health (NUTX) on August 22, 2025. The plaintiffs (shareholders) alleged that they bought Nutex stock at artificially inflated prices between August 8, 2024, and August 14, 2025 (Class Period) and are now seeking compensation for their financial losses. Investors who bought NUTX stock during that period can click here to learn about joining the lawsuit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nutex is a technology-driven healthcare services organization comprising two main divisions: the Hospital Division and the Population Health Management Division. The Hospital Division implements and operates innovative health care models, including micro-hospitals, specialty hospitals, and hospital outpatient departments (HOPDs). The Population Health Management Division operates provider networks like Independent Physician Associations (IPAs), while its Management Services Organizations (MSOs) deliver management and administrative support to affiliated hospitals and physician groups.

The company’s weakness in internal controls is at the heart of the current complaint.

Nutex’s Misleading Claims

According to the lawsuit, Nutex and three of its senior executives and/or directors (the Defendants) repeatedly made false and misleading public statements throughout the Class Period. In particular, they are accused of omitting truthful information about remediation of weaknesses in its internal controls over financial reporting, and other issues, from SEC filings and related material.

At the beginning of the Class Period, Nutex’s CFO stated in an earnings release that the company had reported a 29% revenue increase, Adjusted EBITDA attributable to Nutex Health Inc. of $12.0 million, and a 150% rise in hospital division operating income to $22.8 million for the quarter ended June 30, 2024. The results reflected the company’s continued commitment to revenue growth, stronger cash flow, and improved profitability.

Additionally, in a press release dated November 7, 2024, Nutex’s CEO noted that average insurer payments on patient claims had risen, a positive trend expected to continue as the company progresses its No Surprises Act (NSA) claims through the Independent Dispute Resolution (IDR) process.

Finally, on May 13, 2025, Nutex’s CEO announced in a press release that the company is achieving steadier financial performance driven by both higher patient volumes and improved operational efficiency, along with more equitable payments resulting from the arbitration process.

However, subsequent events (detailed below) revealed that Nutex’s third-party IDR vendor, HaloMD, was achieving lucrative arbitration results for Nutex by engaging in a coordinated scheme to defraud insurance companies.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the company’s business practices and prospects during the Class Period. Importantly, the defendants failed to inform investors that revenues attributable to the company’s engagement with HaloMD in the IDR process were unsustainable due to the latter’s fraudulent conduct.

The information first became clear after the market closed on August 5, 2025, when a Blue Orca Capital report alleged that HaloMD secured exceptionally high profits for clients such as Nutex by participating in a coordinated fraudulent scheme designed to extract millions of dollars from insurance companies in collaboration with its healthcare billing clients.

Furthermore, after the market closed on August 14, 2025, Nutex announced that it would delay filing its Form 10-Q for the quarter ended June 30, 2025, citing non-cash accounting adjustments related to the treatment of stock-based compensation obligations for certain hospitals that are under construction or in the ramp-up phase, as previously disclosed. Following the news, NUTX stock plunged 16.4% on August 15.

This news, together with the company’s failure to meaningfully rebut the allegations in the Blue Orca Capital Report beyond a brief statement issued on July 24, 2025, led to a substantial decline in its stock price.

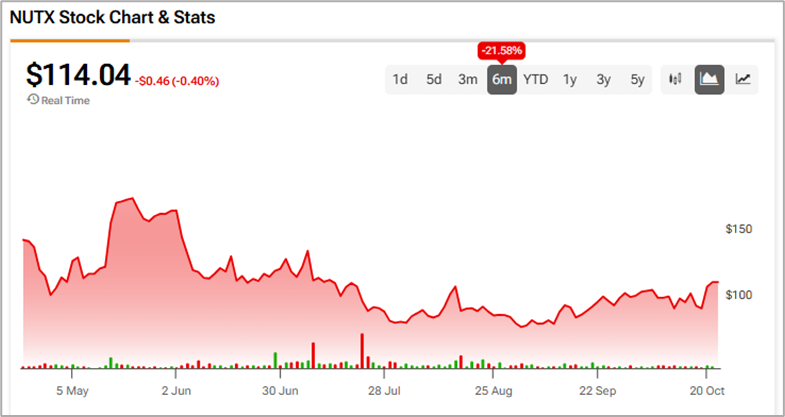

To conclude, the defendants failed to inform investors that, due to internal control weaknesses, the company had improperly classified certain stock-based compensation obligations as equity rather than liabilities, increasing the risk that Nutex would be unable to file certain financial reports with the SEC on time. Due to these issues, NUTX stock has lost more than 21% over the past six months.