Biopharmaceutical company Nurix Therapeutics (NASDAQ:NRIX) recently reported financials that beat expectations, unleashing a 20% climb in the stock’s share price over the past week. The company’s robust pipeline of clinical-stage candidates and an impressive roster of partner relationships could make this stock an attractive addition to a biotech investor’s portfolio.

An Innovative Treatment Pipeline

Nurix Therapeutics is a clinical-stage biopharmaceutical company specializing in discovering, developing, and commercializing innovative therapies for cancer, inflammatory conditions, and other challenging diseases.

Currently, Nurix has three wholly owned clinical-stage drug candidates for hematologic malignancies, solid tumors, and inflammatory diseases. Nurix has also secured strategic alliances with Gilead Sciences, Sanofi, and Pfizer to bolster the discovery and co-development of targeted treatments. In particular, the agreement with Gilead could be worth up to $1.7 billion.

Recent Financial Results and Outlook

The company recently announced quarterly earnings for the quarter that ended February 29, 2024. Revenue came in at $16.6 million, representing a significant rise of 30.74% compared to the same period last year. Nurix reported a net loss of $41.5 million for the quarter, or -$0.76 per share, less than the consensus expectation of -$0.78 per share.

The company finished the quarter with cash, cash equivalents, and marketable securities amounting to $254.3 million. Nurix also disclosed pricing details for its underwritten public offering, which it expects to attract gross proceeds of around $175 million.

What is the Price Target for NRIX Stock?

The stock has been trending upwards, climbing over 60% YTD, with shares recently reaching a 52-week high. The stock continues to demonstrate positive price momentum, trading above the 20-day (13.70) and 50-day (12.28) exponential moving averages. However, with the run-up in price, it now looks to be trading at a relative premium, with a P/S ratio of 11.3x compared to the Biotechnology industry average of 9.4x.

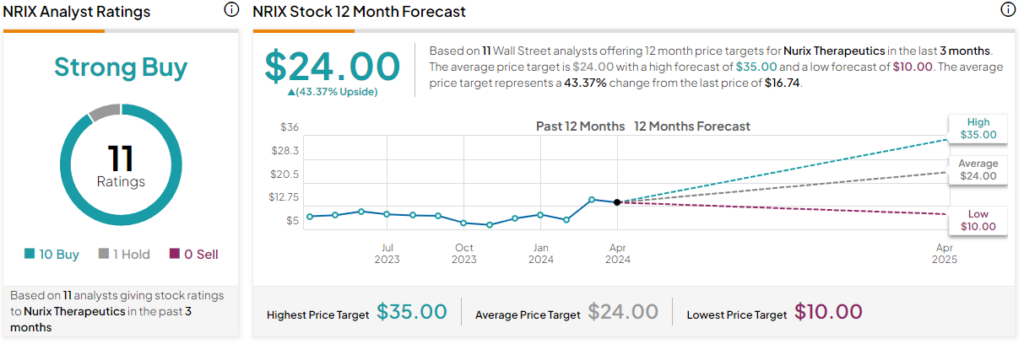

Analysts covering the company have been bullish on the stock. For instance, Baird analyst Joel Beatty recently raised his price target on the stock from $24 to $25. He reiterated an Outperform rating, citing the belief that clinical data on pipeline candidates will be positive.

Nurix is rated a Strong Buy overall, based on the recommendations and 12-month price targets assigned by 11 Wall Street analysts in the past three months. The average price target for NRIX stock is $24.00, which represents a 43.37% upside from current levels.

Big Picture on Nurix

Nurix is well-positioned for growth thanks to a robust pipeline of potential treatments, a replenished war chest of fresh capital, and strategic partnerships with key players like Pfizer, Sanofi, and Gilead. While the stock isn’t cheap by relative measures, it likely reflects the near-term growth potential that strong clinical results could catalyze. As such, the stock could be a compelling play for biotech investors.