Nuclear stocks climbed on Wednesday after the U.S. Army announced a new plan to roll out small nuclear reactors. NuScale Power (SMR) led the rally, while Oklo (OKLO) and Nano Nuclear (NNE) followed. Uranium producer Centrus Energy (LEU) also moved higher. These gains suggest investors are hoping that the Army’s push into nuclear power could help speed up the growth of these companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Army’s project, called the “Janus Program,” is being run with the Defense Innovation Unit. In addition, it will build micro nuclear reactors that are owned and operated by private companies, with the goal of helping them scale up. The program follows President Donald Trump’s executive order in May, which required the Defense Department to have an advanced reactor operational at a U.S. military base by September 30, 2028. By setting a clear timeline while providing backing from the military, the program gives the industry a boost in credibility.

Despite the excitement, most of these companies are still in their early stages. Oklo and Nano Nuclear have not generated any revenue yet, while NuScale reported only $8 million in revenue for the second quarter. Still, demand for more energy from artificial intelligence, combined with Trump’s orders, has kept investor interest strong.

Which Nuclear Stock Is the Better Buy?

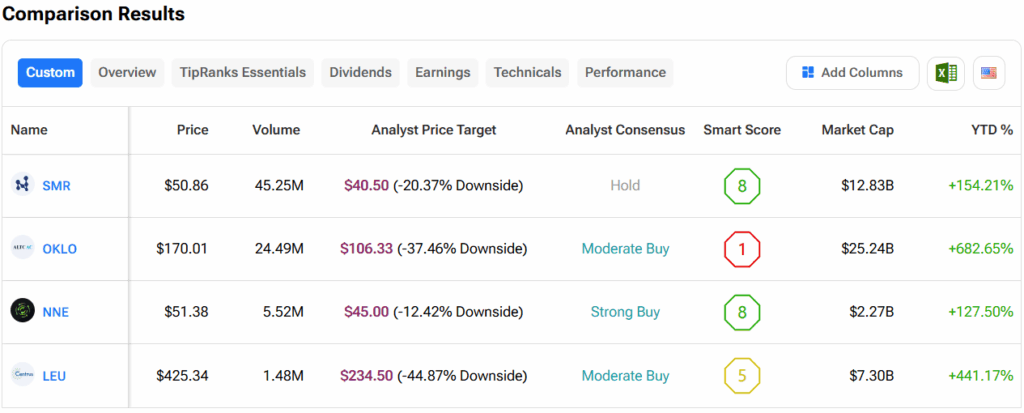

Turning to Wall Street, out of the four stocks mentioned above, analysts think that NNE stock has the least room to fall. In fact, NNE’s average price target of $45 per share implies 12.4% downside risk. On the other hand, analysts expect the least from LEU stock, as its average price target of $234.50 equates to a loss of 44.9%.