Danish pharmaceutical powerhouse Novo Nordisk A/S (NVO), renowned for its leadership in diabetes and obesity care, has confirmed the submission of an unsolicited proposal to acquire U.S.-based pharma developer Metsera (MTSR). The proposed acquisition—valued at approximately $6.5 billion in equity and up to an additional $2.5 billion in contingent value rights (CVRs)—marks Novo Nordisk’s most ambitious expansion move since the GLP-1-driven boom that has redefined the company’s global profile.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

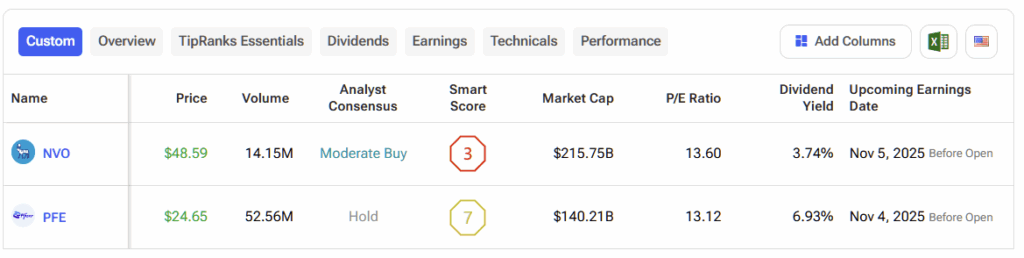

The takeover move has led to a sharp appreciation of MTSR stock (and a sharp response from Pfizer (PFE) management, with shares now trading above $70—a far cry from the sub-$50 levels the stock had been trading at for over five years.

Under the terms of the proposal, Novo Nordisk intends to purchase all outstanding Metsera common stock for $56.50 per share in cash, along with CVRs worth up to $21.25 per share tied to future clinical and regulatory milestones. If completed, the acquisition would give Novo Nordisk access to Metsera’s promising portfolio of early and mid-stage incretin and non-incretin analogue peptide programs—assets that complement Novo Nordisk’s existing research and could expand its dominance in metabolic and endocrine disease treatment.

In an official statement, Novo Nordisk said the deal would align with its long-term strategy “to develop innovative and differentiated medicines” and “treat millions more people living with obesity and diabetes.” With nearly 46 million patients currently on its therapies worldwide, and around 12 million using its GLP-1 therapies, Novo Nordisk sees Metsera’s research capabilities as a path to extend its leadership and pipeline depth in the incretin class—one of the fastest-growing segments in global pharmaceuticals.

Pfizer Pushes Back

No sooner had Novo Nordisk revealed its bid than its top pharmaceutical rival, Pfizer, fired back with a swift and combative response. With its own agreement to acquire Metsera already in motion, Pfizer denounced Novo Nordisk’s proposal as “reckless and unprecedented,” accusing the Danish company of trying to stifle competition and “circumvent antitrust laws.” PFE’s sternly-worded statement went on to describe NVO’s takeover proposal as “illusory.”

According to Pfizer, Metsera’s board previously rejected Novo Nordisk’s proposal due to “a variety of risks” in its deal structure, opting instead for Pfizer’s offer, which it claims provides greater certainty and regulatory clarity. Pfizer further emphasized that its agreement with Metsera “creates real, certain and immediate value for shareholders,” while ensuring that Metsera’s pipeline—including a key next-generation drug candidate in metabolic disorders—remains accessible to U.S. patients.

With both companies now locked in a high-stakes showdown, regulatory scrutiny seems all but inevitable. Novo Nordisk’s meteoric rise in the obesity and diabetes sectors—driven by its blockbuster drugs Ozempic and Wegovy—has already drawn antitrust attention in multiple jurisdictions. The pharmaceutical giant is also facing mounting legal challenges from prosecutors in several regions, including the U.S. The Metsera bid may intensify those concerns, particularly in the U.S., where lawmakers are increasingly wary of foreign acquisitions that could limit competition in high-demand therapeutic areas.

Strong Momentum Leads to Growing Pains

The proposed acquisition comes amid a mixed financial year for Novo Nordisk. During the first six months of 2025, the company reported 18% sales growth and 29% operating profit growth at constant exchange rates, driven largely by its obesity care segment, which surged 58% year over year. International operations performed exceptionally well, with Wegovy sales skyrocketing 335% outside the U.S.

All of that success has done little for its share price, though. NVO stock continues to trend lower since its recent highs of ~$150 back in the summer of last year.

The recent Metsera takeover bid also comes just as both firms report Q3 results, which puts even more spice into tomorrow’s earnings call. Earlier today, Pfizer beat earnings expectations, reporting EPS of $0.87 (compared to the expected $0.64) and revenue of $16.65 billion (compared to the expected $16.5 billion).

Even though weight-loss drugs are popular, the company’s momentum has been tempered by new challenges. Novo Nordisk recently lowered its full-year 2025 outlook, citing weaker-than-expected growth for Wegovy and Ozempic in the U.S. market.

One significant headwind has been the rise of unregulated compounding pharmacies, which the company estimates are supplying GLP-1 drugs to more than 1 million patients—often without FDA oversight. In addition, free cash flow decreased to DKK 33.6 billion (~$5 billion) in the first half of 2025, from DKK 41.3 billion a year earlier, primarily due to increased capital expenditures aimed at expanding production capacity. Sales growth for the current year is now expected to plateau at between 8% and 14%, well below earlier projections.

NVO Shareholders Face Strategic Crossroads

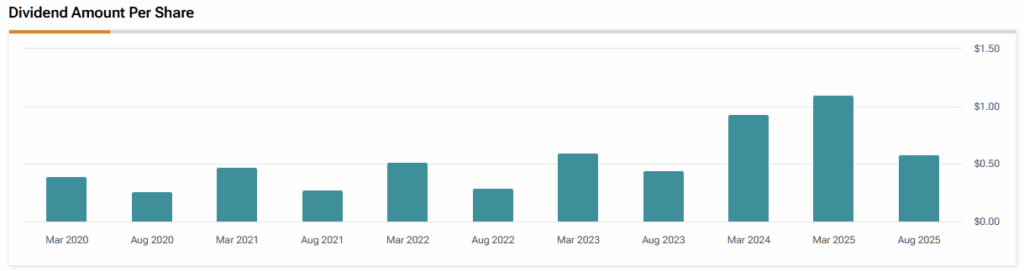

For Novo Nordisk and its shareholders, the sight of a steadily declining share price is troubling enough—but even the comfort of a once-reliable dividend is slipping away. The company’s dividend per share has dropped from over $1 in March to just above 50 cents by the third quarter, eroding one of the few remaining safe harbors amid market volatility.

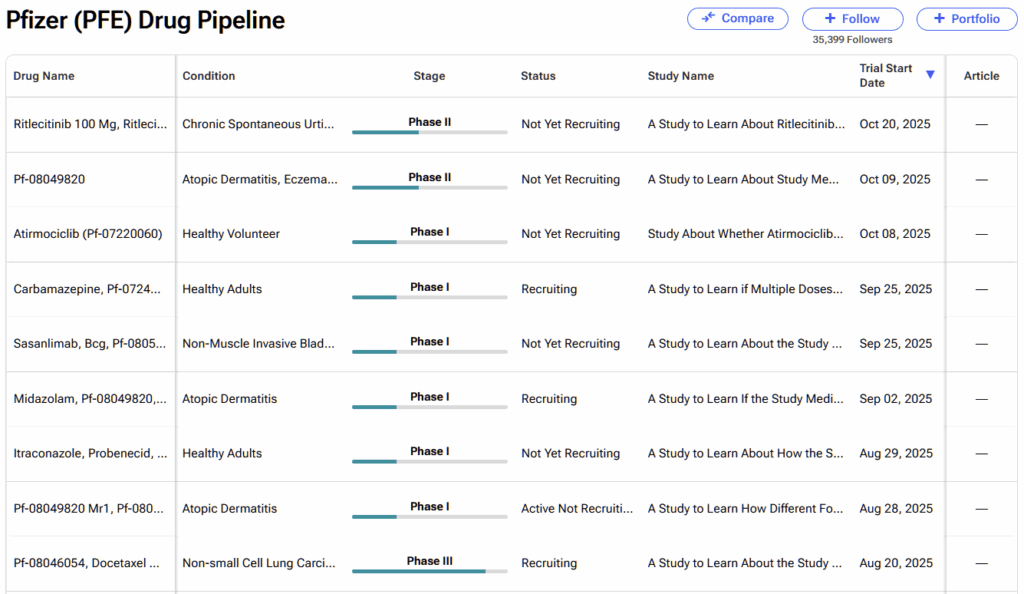

Acquiring Metsera could serve as both a defensive and offensive play—defensive in the sense of maintaining dominance over the incretin market amid intensifying competition from Eli Lilly (LLY) and Pfizer, and offensive by broadening its peptide-based R&D pipeline. Despite its size, the firm may have to overcome a courtroom tussle with Pfizer for the deal to progress.

At the same time, Novo Nordisk is pushing amycretin into Phase III trials and has recently secured a positive EMA opinion for Ozempic in the treatment of peripheral arterial disease—clear signs of continued innovation beyond diabetes. Even if the Metsera deal falls through, NVO’s management is likely confident that other promising opportunities await on the horizon.

Regardless of how the Metsera bid plays out, the proposal’s reception and potential regulatory challenges highlight the delicate balance between growth and oversight in the modern biopharmaceutical landscape. Whether Novo Nordisk’s bid succeeds—or triggers a prolonged legal and political battle—remains to be seen. What is clear is that NVO’s ambitions continue to reshape not only its own future, but also that of its patiently suffering shareholders, as the race to define the next era of metabolic medicine intensifies.