Pharmaceutical firm Pfizer (PFE) has filed a second lawsuit against Novo Nordisk (NVO) and obesity drug maker Metsera (MTSR) by claiming that Novo is trying to shut out future competition. More precisely, the lawsuit, filed Monday in a U.S. District Court in Delaware, says that Novo Nordisk’s attempt to outbid Pfizer for Metsera is anticompetitive. Pfizer argues that the Ozempic maker is using this deal to protect its dominant position in the weight-loss drug market by removing a potential competitor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Pfizer also claims that Metsera’s controlling shareholders teamed up with Novo to undermine Pfizer’s original deal. Metsera quickly responded by saying that Pfizer is just using lawsuits to try to buy the company for less money. Metsera called Pfizer’s claims “nonsense” and said it would fight back in court. Interestingly, this legal battle comes after Pfizer announced in September that it planned to buy Metsera for $4.9 billion, or up to $7.3 billion with future payments.

The deal was seen as a major move by Pfizer to finally gain traction in the weight-loss drug space after its own efforts fell short. However, last Thursday, Novo Nordisk made a $6 billion bid for Metsera and gave Pfizer four business days to match or improve its offer. As a result, Pfizer quickly filed its first lawsuit the next day to stop Metsera from ending their original deal. In that case, filed in Delaware’s Court of Chancery, Pfizer argued that Novo’s offer poses too much regulatory risk and isn’t likely to go through.

Which Drugmaker Is the Better Buy?

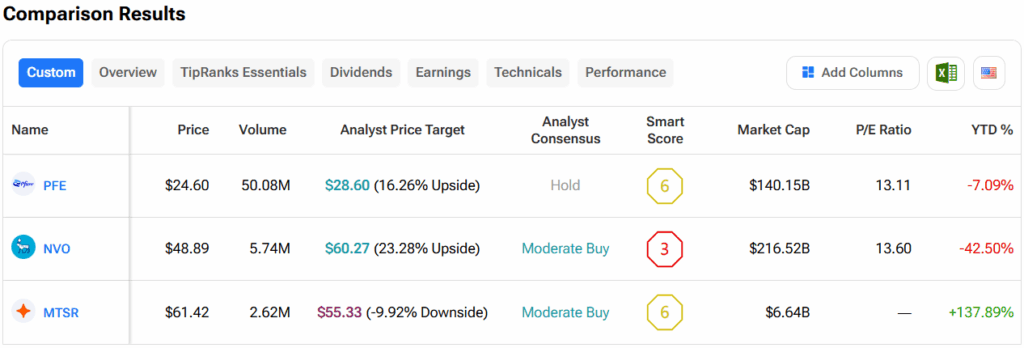

Turning to Wall Street, out of the three stocks mentioned above, analysts think that NVO stock has the most room to run. In fact, NVO’s average price target of $60.27 per share implies more than 23% upside potential. On the other hand, analysts expect the least from MTSR stock, as its average price target of $55.33 equates to a loss of 10% should an acquisition not occur.