According to the National Institute of Health, around one in seven women can develop postpartum depression following childbirth. Until recently, the treatment for new mothers suffering from postpartum depression has been limited to psychotherapy or general antidepressants. Sage Therapeutics (NASDAQ:SAGE) has recently brought to market the first and only FDA-approved oral treatment specifically developed for postpartum depression, offering potential upside for this biopharma company.

However, market participants have thus far been unimpressed, and the stock is down over -70% in the past year. It trades at a discount, and offers potential upside as the new treatment gains recognition and further distribution. This could make SAGE a compelling candidate for investors looking for an interesting biopharma stock to consider.

A Deeper Look at Sage Therapeutics

Sage Therapeutics is a biopharmaceutical company focused on developing therapies for brain health. The company, which now has an FDA-approved treatment for postpartum depression, has also made significant progress in researching and developing innovative medicines related to other neurological and neuropsychiatric disorders.

Developed in partnership with Biogen Inc. (NASDAQ:BIIB), Sage’s ZURZUVAE, a first-of-its-kind oral treatment for postpartum depression, was approved by the FDA in August 2023 and became commercially available in the U.S. in December 2023. The company reports over 1,200 prescriptions already written by a diverse array of physicians.

Meanwhile, Sage’s other drug, Dalzanemdor, is being developed as a potential oral therapy for cognitive impairment linked to certain neurodegenerative disorders, like Alzheimer’s and Huntington’s Disease. The company had disappointing Phase-2 results on the benefits of this treatment for Parkinson’s, so the market is keenly watching for Phase-2 test results on clinical trials targeting other disorders.

Analysis of Sage Therapeutics Recent Financial Results

Sage recently announced a significant revenue rise in Q1 2024, with total revenue reaching $7.9 million, up from $3.3 million in Q1 2023. This surge was chiefly driven by the first complete quarter of sales for ZURZUVAE. Additionally, the company earned a milestone payment of $75 million with the first commercial sale of ZURZUVAE, received from Biogen in January 2024.

Despite the positive revenue performance, the company experienced a net loss of $108.5 million in Q1 2024. The EPS of -$1.80 exceeded the expected loss per share of -$1.65, though it was a significant improvement from the -$2.46 EPS posted in the same period in 2023.

The company has reported $717 million in cash, cash equivalents, and marketable securities as of March 31, 2024. From its current operating projections, Sage envisages that its current and anticipated assets, along with estimated revenues, will support its operations into 2026.

What is the Price Target for SAGE Stock?

The stock had been trending lower thus far this year, though post-Q1 earnings shares have seen a bit of a pop, rising just under 5% over the past week. The stock currently trades at the low end of its 52-week price range of $10.92-$59.99. It appears to be a relative value, with the EV/Revenues of 1.17x comparing favorably with the Biotechnology industry average of 9.28x.

Analysts following the company have taken a cautious stance on the stock. For example, H.C. Wainwright analyst Douglas Tsao recently lowered his price target on Sage Therapeutics to $25 from $28, while reiterating a Neutral rating on the shares. Though encouraged by the early uptake for ZURZUVAE, he is taking a more conservative stance on Dalzanemdor, given its recent disappointing Phase-2 trial.

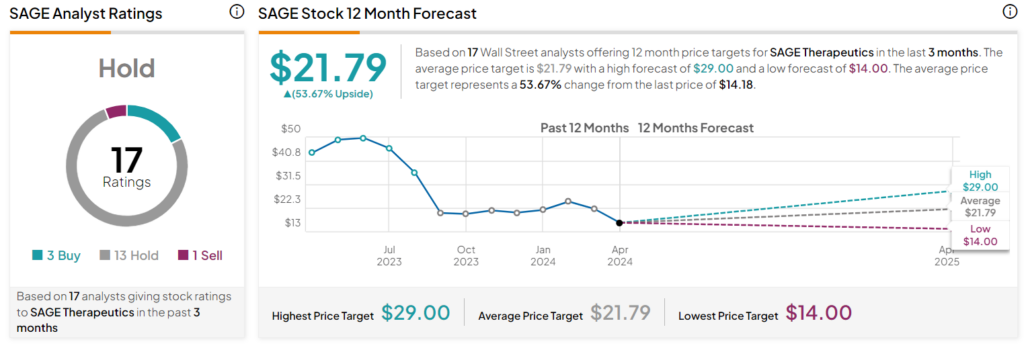

SAGE Therapeutics is rated a Hold based on the recommendations and 12-month price targets issued over the past three months by 17 Wall Street analysts. The average price target for SAGE stock is $21.79, which represents a 53.67% upside from current levels.

SAGE Therapeutics in Summary

Developing and bringing to market a novel therapy is challenging, time-consuming, and costly. Most treatment candidates don’t make it, and there is no guarantee that the few that do will become “blockbuster” sensations. With roughly 3.5 to 4 million births a year in the U.S., the total addressable market for postpartum depression is large enough to represent a significant growth opportunity for SAGE Therapeutics. It is a speculative biopharma stock, trading at a relative discount with potential upside, making it an intriguing investment opportunity worthy of further exploration.