Swiss pharmaceutical giant Novartis (NVS) has secured the approval of the U.S. health regulator for its new pill Rhapsido. The news appears to have slightly cheered investors, with NVS stock up 0.4% in early trading on Wednesday, following a 3% gain the previous day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rhapsido is targeted at treating chronic spontaneous urticaria (CSU) in adult patients. CSU is a skin condition that causes itchy red bumps or hives on the skin without a known cause, persisting for several weeks. These bumps can resemble mosquito bites and appear anywhere on the body.

Novartis Develops ‘Unique Approach’ to CSU

The approval marks Novartis’s latest win in its efforts to expand its portfolio and deepen its presence in the U.S. According to the Swiss drugmaker, the new pill is designed for patients who continue to get these symptoms despite taking allergy pills. The oral treatment requires no injections or lab monitoring, only a pill to be taken twice daily.

Furthermore, Novartis pointed out that Rhapsido is the first medication approved by the U.S. Food and Drug Administration to block Bruton’s tyrosine kinase, the protein involved in triggering allergic reactions in people who have CSU. It described the pill as “a unique approach to CSU treatment.”

Novartis Deepens U.S. Footprint

Meanwhile, the approval comes as Novartis continues to consolidate its business presence in the U.S. In recent weeks, the Basel-based pharmaceutical company has signed a $5.7 billion deal with Monte Rosa (GLUE), entered a $200 million drug development arrangement with Arrowhead (ARWR), and is planning to buy out Tourmaline Bio (TRML) in a $1.4 billion deal.

Moreover, the company is making preparations toward the launch of a platform to directly sell Cosentyx to patients at a 55% discount starting November 1. Cosentyx is a prescription medicine used to treat autoimmune conditions like psoriasis and arthritis.

The development comes even as President Donald Trump continues to use tariffs to compel American pharmaceuticals to lower drug prices for Americans, with Pfizer (PFE) agreeing on Tuesday to heavily discount some of its most popular drugs. Other major pharmaceuticals are expected to follow suit.

Is NVS Stock a Buy?

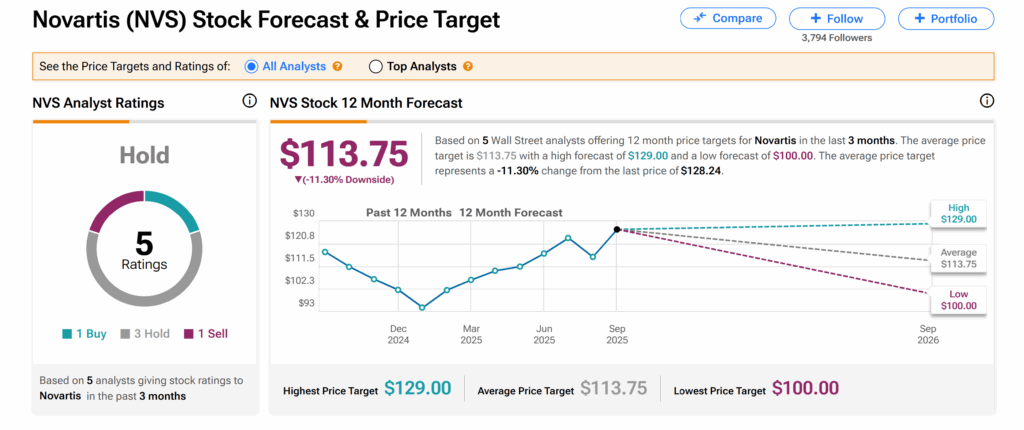

Turning to Wall Street, Novartis’s shares currently have a Hold consensus rating on TipRanks, based on one Buy, three Holds, and one Sell assigned by five Wall Street analysts over the past three months. This is even as the average NVS price target of $113.75 points to an 11.30% downside risk.