They say that no news is good news. But for bank stock U.S. Bancorp (NYSE:USB), no news turned out to be bad news. At least, that’s the story from Piper Sandler, who cut its rating on U.S. Bancorp as a result. That was enough for investors to sour a bit on the bank and send shares down fractionally in Friday afternoon’s trading. There wasn’t any specific bad news that prompted Piper Sandler analysts, led by Scott Siefers, to cut U.S. Bancorp from Overweight to Neutral. But then, there wasn’t any specific catalyst that would have prevented such a cut, either.

Basically, the cut came when Piper Sandler looked at the field and noticed U.S. Bancorp was trading at a premium against other banks in the sector but didn’t have any news in the pipeline that would merit a premium price being in place. Thus, it pared back the rating because there simply wasn’t enough going on to justify its pricing.

There Might be Some Troubles Ahead

While there isn’t much in the way of a positive near-term catalyst afoot for U.S. Bancorp, there might be some troubles ahead all the same. Reports note that U.S. Bancorp added $8.4 billion in long-term debt to its ledgers, which puts the total up to $51.5 billion. That sounds like a lot, and it should; it’s actually the highest the number has been since the pandemic kicked in back in 2020. And it gets worse; U.S. Bancorp is also fighting “Right to Gripe” suits in California, where customers have, by law and statute, the right to publicly express their grievances against the bank. Even if U.S. Bancorp has the right to it here, it’s still terrible optics.

Is U.S. Bancorp a Good Stock to Buy Now?

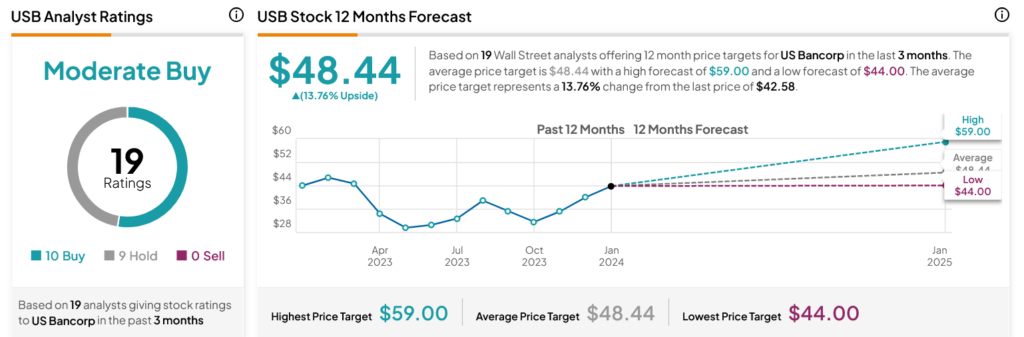

Turning to Wall Street, analysts have a Moderate Buy consensus rating on USB stock based on 10 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 7.93% loss in its share price over the past year, the average USB price target of $48.44 per share implies 13.76% upside potential.