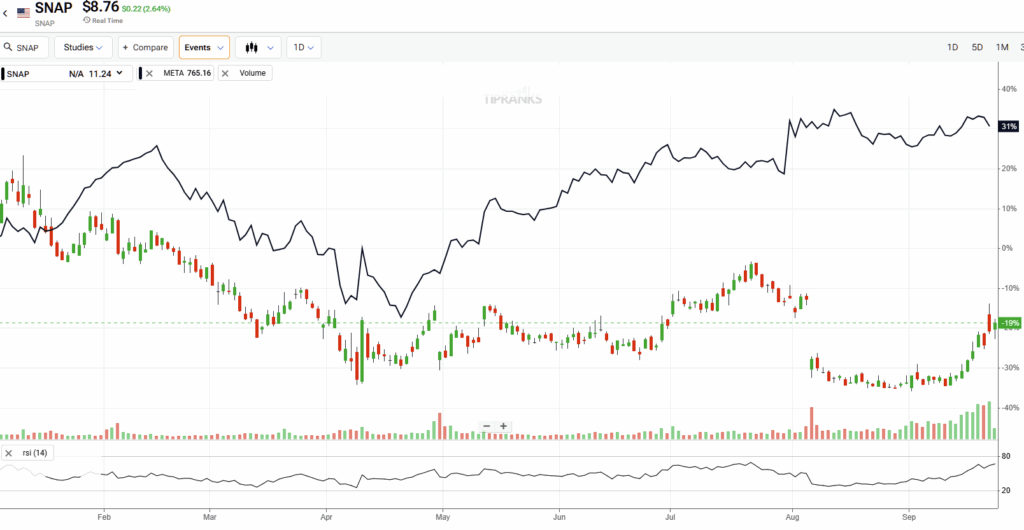

Snap Inc. (SNAP), the parent of Snapchat, came under pressure last week after Guggenheim analysts struck a cautious tone following their review of Q3 user growth. The stock has fallen 24% year-to-date, in stark contrast to Meta Platforms (META), which has climbed over 30%. I believe the market’s skepticism is justified, as Snap still lacks clear, defensible competitive advantages to drive sustained growth and monetization.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While recent monetization trends show improvement, I remain neutral on Snap’s outlook. The company is still playing catch-up to larger social media peers, and at a forward P/E of 31, the stock appears fairly valued.

Snap is Losing Ground in Its Most Important Market

One of the main reasons behind my cautious stance on Snap is its lackluster user retention in North America. In Q2, despite global Daily Active Users growing by 9% YoY, North America DAUs declined by 2% YoY to 98 million.

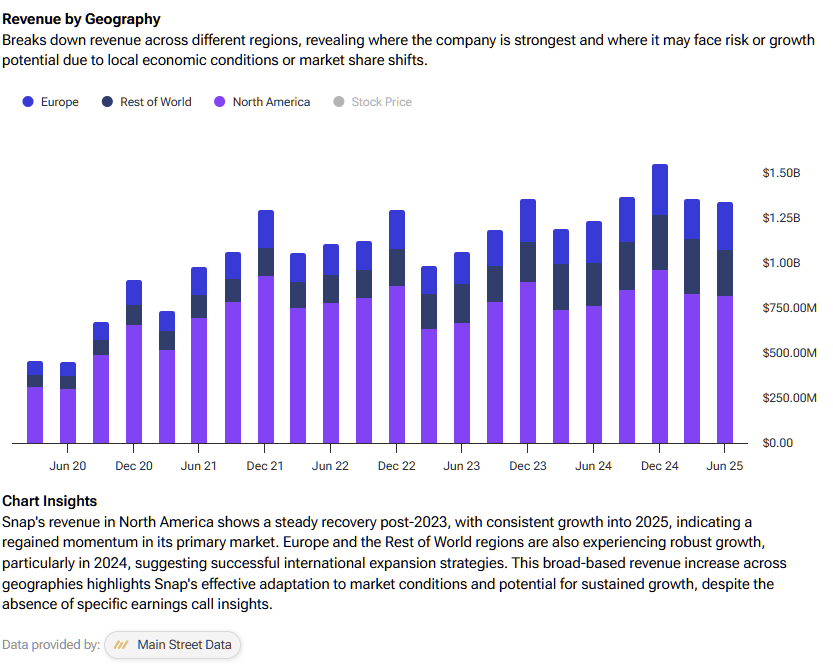

According to company filings, North America is the most significant contributor to company revenue and its most lucrative market, as evidenced by average revenue per user of $8.33 compared to the global ARPU of just $2.87. Given the outsized contribution of the North America segment to total revenue, failure to at least maintain its North America user base could lead to a notable decline in revenue in the long run.

Snap, unfortunately, has found itself in a challenging position in North America due to structural headwinds. Snap’s primary audience is the Gen Z demographic.

According to data from eMarketer and Kantar, the total Gen Z population in the U.S. and Canada is approximately 80 million. Given that Snap has already captured the majority of this market, the company now needs to focus on penetrating much older user cohorts, which is proving to be difficult due to Snap’s intrinsic features that are targeted toward the younger generation. Intense competition from TikTok to capture the attention of the young generation has also dampened Snap’s prospects.

SNAP’s Impressive Monetization Progress

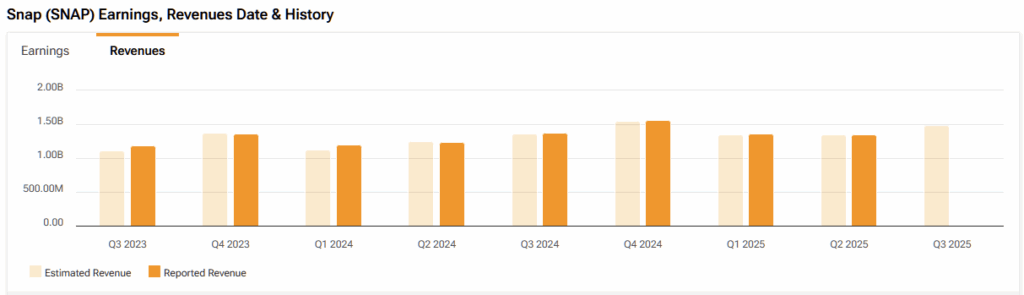

Although I am cautious about the prospects for Snap due to its lackluster user growth trends in its most important market, there is no denying the progress the company has made in monetizing its user base over the past couple of years. Snapchat+, the premium subscription service introduced in June 2022, is proving to be a big hit, paving the way for higher monetization levels.

In Q2, Snap reported a 64% YoY increase in other revenue, which was primarily driven by Snapchat+ subscription growth. As of Q2, the company had ~16 million paying subscribers with an annualized revenue run rate of around $700 million.

In addition to Snapchat+, the company appears to be focused on enhancing the advertiser experience on its platform, which is a step in the right direction, as its competitors, such as TikTok and Instagram, offer highly advanced ad performance metrics to marketers.

While investing in improving the ad publisher experience, Snap is also experimenting with innovative categories, such as Sponsored Snaps. According to CEO Evan Spiegel, these new ad inventories will be accretive to long-term revenue growth despite lowering platform-wide eCPMs in the second quarter. Another bright spot is the continued growth in time spent on Spotlight (40% YoY in Q2), which allows the company to target these eyeballs for monetization.

TikTok’s Clear and Present Threat

Although I am impressed by the recent initiatives introduced by Snap to monetize its active user base, I firmly believe that the company faces a significant threat from TikTok, which extends beyond the two platforms targeting the same audience. To compete directly with TikTok, Snap introduced its Spotlight feature. As highlighted earlier, time spent on Spotlight is growing.

However, Snap is forced to undergo a radical transformation of its platform, changing its value proposition from a peer-to-peer communication platform to a social media platform that mimics TikTok. This platform disruption may prove to be costly in the long run, as active users may leave the platform for alternatives. In addition, these changes force Snap to reassess its monetization strategy due to differences in user content consumption habits.

Moreover, the market now has to deal with the reality that TikTok is likely to have a permanent presence in the U.S., unlike initially thought. Snap stock has been riding on expectations for a permanent ban on TikTok in the U.S., which would have significantly tilted the odds in favor of the platform, given that TikTok is Snap’s closest rival.

However, the White House announced earlier this week that it has reached an agreement with the parent company of TikTok, allowing the U.S. to have some control over the platform’s operations within the country. As part of this agreement, six out of seven board seats for TikTok’s U.S. operations are expected to be held by Americans.

Is Snapchat a Buy, Sell, or Hold?

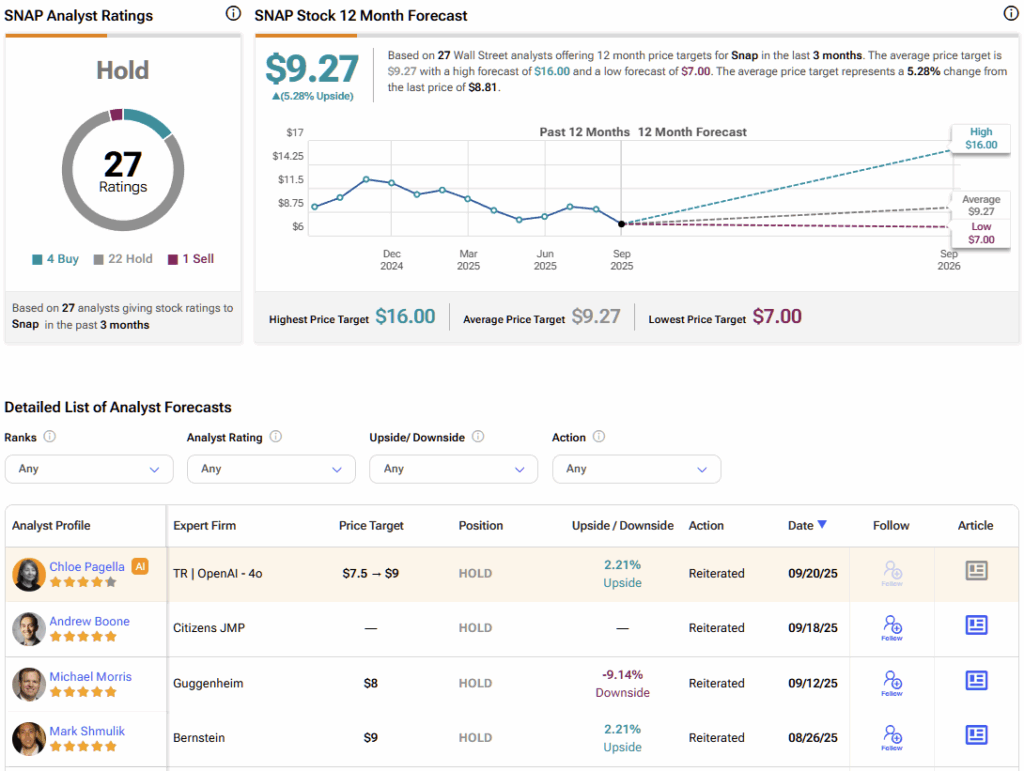

On Wall Street, SNAP stock carries a Hold consensus rating based on four Buy, 22 Hold, and one Sell ratings over the past three months. SNAP’s average stock price target of $9.27 implies approximately 5% upside potential over the next twelve months.

Although analyst ratings imply limited upside potential, I am concerned about Snap’s current valuation level. The tech stock is currently valued at a forward P/E multiple of 31x, whereas Meta, which is substantially more profitable (2024 net income of $71 billion vs a loss of $697 million for Snap), is valued at a cheaper forward earnings multiple of 27x. Given the challenges faced by Snap and the lack of durable competitive advantages, I believe its current valuation leaves no margin of safety for investors.

Snap Looks Overvalued Amid Fierce Competition

Although Snap has made strides in improving monetization, the company faces significant challenges, including U.S. market saturation and fierce competition from rivals such as TikTok. Moreover, its need for a radical platform overhaul adds another layer of execution risk for investors. Compared with Meta—whose scale and profitability are far greater—Snap looks overvalued, a mismatch that is difficult to justify. For these reasons, I remain Neutral on Snap’s outlook.