Shares of the Chinese EV (electric vehicle) maker Nio (NYSE:NIO) are trending lower and are down about 41% year-to-date. As NIO stock continues to slide and is heading towards penny-stock (learn more about penny stocks here) levels, we wonder what investors’ sentiment and hedge funds’ activity suggest about its prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

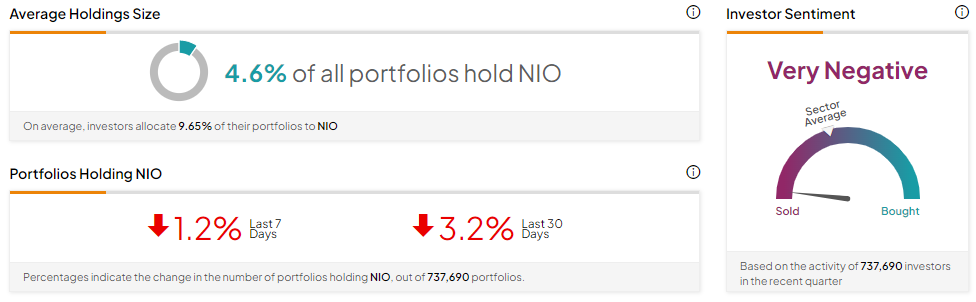

Individual investors have a Very Negative view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock decreased by 3.2%. This suggests that investors are still not capitalizing on the dip in Nio stock.

Learn more about TipRanks’ powerful Investor Sentiment tool here.

Hedge Funds Sold NIO Stock

It’s important to highlight that the overall dip in EV demand due to elevated interest rates has hurt stocks like NIO. Additionally, increased price competition has squeezed margins, leading to a downturn in the shares of companies operating in the EV sector.

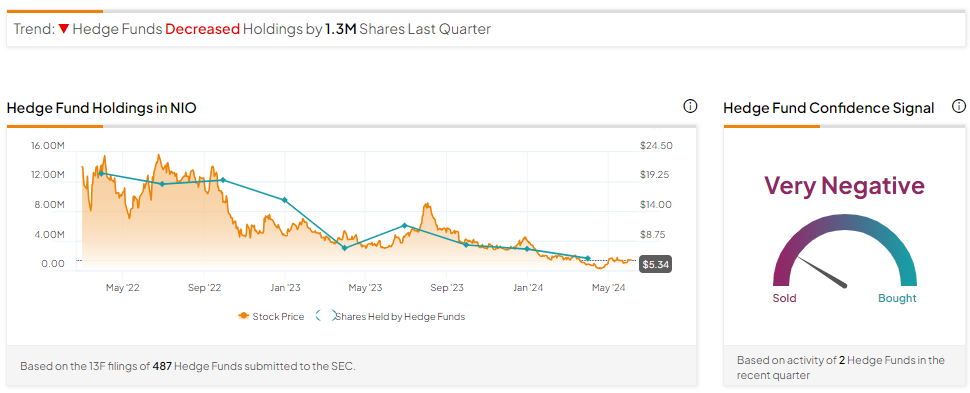

Also, the Hedge Fund Confidence Signal is Very Negative for Nio stock based on the activity of two hedge funds. Hedge funds decreased their Nio holdings by 1.3M shares in the last quarter.

Is NIO a Buy or Sell?

Wall Street is cautiously optimistic about Nio stock due to weak EV demand and competitive headwinds. Overall, Nio stock has a Moderate Buy consensus rating based on eight Buys, nine holds, and one Sell recommendation.

Analysts’ average price target on NIO stock is $6.66, implying an upside potential of 24.72% from current levels.

Bottom Line

While Nio stock is under pressure, the company’s deliveries reached 20,544 vehicles in May 2024, representing a year-over-year increase of 233.8% year-over-year. This suggests that the demand environment is showing signs of revival in China. It remains to be seen whether Nio stock enters penny stock territory or bounces back from the current levels.

Meanwhile, investors can leverage TipRanks’ penny stock screener to find top-rated penny stocks.