While electric vehicles, EVs, have been generating tremendous hype, and while they are the beneficiaries of a heavy push from governmental regulatory agencies to promote their adoption, the fact remains that EVs have not been selling as well as industry analysts expect, and EV stocks, in general, have been lagging the markets over the past year.

The reasons are several, and bear some examination. To start with, the inflation/interest rate environment in the past few years has simply not been favorable for big-ticket purchases – and even subsidized, EVs remain expensive. On top of that, the vehicles have only recently begun to surpass their limitations on range-per-charge – but charging station networks are still not sufficient to maintain a nationwide EV fleet. These headwinds have put serious pressure on EV stocks.

And now the good news. Battery technology is improving, and vehicle ranges along with it. While EVs remain expensive, and the charging network is expanding only slowly, high gasoline prices at the pump provide additional support for going electric.

Covering the EV space from Barclays, sector expert Jiong Shao is taking the measure of China’s EV makers. This should come as no surprise; per the Harvard Business Review, China accounted for some 60% of global EV sales this past January. Shao takes this fact forward and picks out the superior EV stock to buy from the Chinese market. Let’s take a closer look.

Nio (NIO)

The first stock we’ll look at is Nio, one of China’s leading EV companies. Nio was founded in 2014 and after several years of design, prototype, and facility development, began regular vehicle production of its first two EV models in 2019. With nearly 5 years of vehicle output now under its belt, Nio has 9 models on the market. While the company’s lineup leans toward SUVs, it also includes sedans and coupes, and features vehicles in both the mid- and full-size classes.

Nio has built up its vehicle styling and their long battery ranges as important marketing points – and they are. But perhaps more importantly for Nio is the company’s Battery-as-a-Service model. Nio treats vehicle battery pack replacement at service centers as an alternative to plug-in charging; subscribers can drive into a service station, have a depleted car battery swapped for a fresh one, and drive away. It’s an innovative alternative to spending hours with the car plugged into a charger port.

Nio is also working on intelligent and/or assisted driving systems, as another differentiator for its vehicles. The company is aiming to develop an Autonomous Driving-as-a-Service system, making the technology available to subscribers as needed. Nio’s insight brought the as-a-Service subscription model into the automotive industry, and sets the firm apart from the competition.

Industry analysts, however, were worried when Nio released its March delivery numbers. The company reported 11,896 vehicles delivered in the month, up 14.3% year-over-year, and reported 479,647 total cumulative deliveries as of March 31 this year. The worry came with the forward guidance – the company on March 27 revised its Q1 delivery outlook downward, from a 31K to 35K range down to 30,000. Deliveries in that range would be flat quarter-over-quarter.

Softness in deliveries may be reflected in the earnings report. Nio showed a Q4 top line of $2.4 billion, beating the forecast by $70 million and rising 6.5% year-over-year – but the expectations for Q1 revenues are lower, at $1.48 billion. We’ll see toward the end of this month how Nio’s first quarter turns out.

For analyst Shao, the softness in the deliveries may be the overshadowing point to consider here. He writes of Nio: “With weaker than expected deliveries in March, NIO’s Q1 deliveries came in in line with revised guidance of 30k provided on March 27 but below its original guidance (31k-33k) provided on March 5. Importantly, the miss reflects weaker sales momentum of the new 2024 models which were just launched in early March. With limited new product launches in the pipeline planned for the rest of 2024, we see significant risks for NIO’s ability to meet consensus estimates for the reminder of the year. Longer term, as we have recently highlighted in our research, we believe the hypercompetitive EV market in China is set to become even more competitive.”

Shao follows these comments with a downgrade on NIO, from Equal Weight (i.e. Neutral) to Underweight (i.e. Sell), and sets his price target at $4 to point towards a downside of ~11% on the one-year horizon. (To watch Shao’s track record, click here)

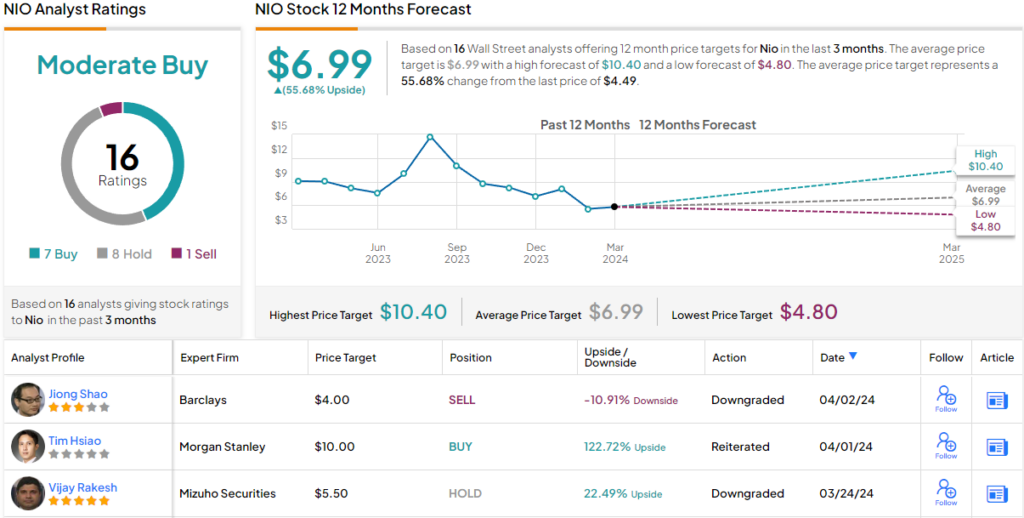

While Barclays has downgraded this stock, the overall view from the Street isn’t quite ready to give up on Nio. The company’s stock has a Moderate Buy consensus rating, based on 16 recent reviews that include 7 Buys, 8 Holds, and 1 Sell. The shares are trading for $4.49 and their $6.99 average price target implies a one-year upside of ~56%. (See Nio stock forecast)

Li Auto (LI)

Next up is Li Auto, another of China’s major EV companies, and one that investors should follow carefully. Li has been successful in moving into China’s large and growing EV field, and has positioned itself as a leader in the latest EV drive train tech. In addition, Li has built a network of dealers and service centers to support its customers.

Li Auto has focused its work on pure-play battery-electric SUV models, and currently has three such on the market. These comprise the Li L7, the firm’s 5-seat flagship SUV model, the L8 and L9, both six-seat battery-powered SUVs. Last November, the company unveiled its MEGA, high-tech, family-oriented MPV, and MEGA deliveries began on March 11.

Like Nio above, Li has realized the importance of customer support, and the company’s network includes 474 retail stores in 142 cities across China, along with 356 service centers to provide both repairs and routine maintenance. The service centers are spread across 209 cities and include body and paint shops. The company has also opened 357 supercharging stations across China, equipped with a total of 1,544 charging stalls.

Turning to deliveries, we find both good and bad news from Li in its recent numbers. In March, the company delivered a total of 28,984 vehicles, for 39.2% year-over-year growth. Q1 deliveries came to 80,400, up almost 53% year-over-year, and cumulative deliveries reached 713,764 as of March 31, making Li the first Chinese EV company to breach 700K total deliveries.

The weak point, however, came from the new MEGA. Sales of the new vehicle were slower than expected, causing the company to revise its Q1 delivery estimate downward, from the 100,000-103,000 range to 76,000-78,000. The company expects that to significantly impact total sales in 2024, although Li is still predicting at least 50% year-over-year revenue growth by the end of this year.

Li will report its 1Q24 numbers in May, and for now, analysts are predicting revenues of approximately $4.43 billion. The company’s stock is up more than 27% in the last 12 months but has slipped 17% year-to-date.

Analyst Jiong Shao believes that the positives overmatch the negatives here, and writes of Li, “We recognize smooth rides don’t exist for any company, let alone one in the ultra-competitive Chinese EV industry. In our recent research, we have highlighted many times that the Chinese EV industry is becoming even more competitive as tech giants such as Huawei and Xiaomi are entering the space; industry consolidation appears inevitable and is likely to happen in the next 3-5 years. However, with LI’s excellent execution (excluding this most recent misstep) over the last few years, we remain OW.”

That Overweight (i.e. Buy) rating comes with a $39 price target that implies a one-year potential gain of ~29% for the stock.

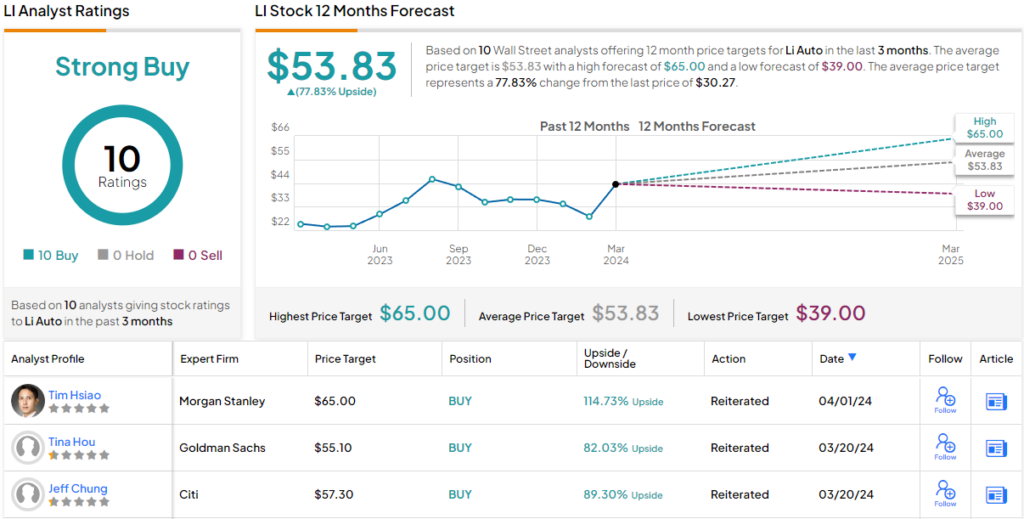

The view from the Street is also bullish – in fact, even more so. Li shares have a unanimously positive consensus rating based on 10 Buy recommendations, and the $30.27 trading price and $53.83 average target price together suggests a bullish 78% one-year upside. (See LI stock forecast)

Summing up, it’s clear that Barclays analyst Jiong Shao has tagged Li Auto as the superior Chinese EV stock for investors to start buying.

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.