Shares of athletic footwear, apparel, equipment and accessories maker NIKE, Inc. (NKE) declined almost 4% to close at $153.32 in extended trade on Thursday after the company reported mixed results for the first quarter of fiscal 2022.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Quarterly revenues jumped 16% year-over-year to $12.25 billion but missed analysts’ estimates of $12.46 billion. The growth in revenues was primarily on the back of a 12% year-over-year rise in the revenues of the NIKE Brand to $11.6 billion, which made up about 95% of the company’s total quarterly revenues.

Earnings per share (EPS) for the quarter stood at $1.16, up 22% from the previous year’s figure of $0.95. Further, it topped the Street’s estimate of $1.11 per share.

Notably, the company’s gross margin also expanded by 170 basis points to 46.5%.

In terms of rewarding its shareholders, NIKE paid dividends of $435 million in the quarter, up 13% from the prior year, while share repurchases amounted to $742 million for the quarter.

The CEO of NIKE, John Donahoe, said, “NIKE’s strong results this quarter are continued proof of our deep consumer connections, unrelenting innovation pipeline and a digital advantage that fuels our brand momentum. We have the right playbook to navigate macroeconomic dynamics, as we create value through our relentless drive to fuel the future of sport.” (See NIKE stock chart on TipRanks)

On September 23, Bank of America Securities analyst Lorraine Hutchinson reiterated a Hold rating on the stock with a price target of $168, which implies upside potential of 5.3% from current levels.

The analyst commented that though supply chain disruptions are impeding the growth of the athletic apparel industry, big players like NIKE are likely to remain largely unaffected.

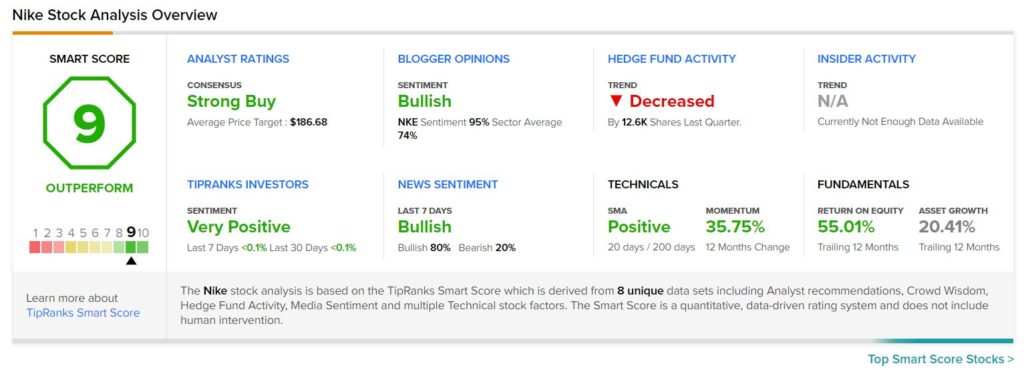

Consensus among analysts is a Strong Buy based on 20 Buys, 3 Holds and 1 Sell. The average NIKE price target of $186.68 implies upside potential of 17% from current levels.

NIKE scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 27.9% over the past year.

Related News:

Blink Launches First Publicly Accessible EV Charging Station

Willis Towers Watson Increases Share Buyback Program by $4B

Paccar Partners with FedEx, Aurora for Commercial Pilot of Autonomous Trucks