Athletic footwear, apparel, equipment, and accessories maker Nike (NYSE:NKE) will release its Q3 Fiscal 2024 financials after the market closes on Thursday, March 21. A tough year-over-year comparison and macro headwinds, primarily in China and Europe, the Middle East and Africa (EMEA), will likely weigh on NKE’s Q3 financials. Several challenges lead investors to expect a disappointing Q3 earnings report.

Notably, Nike stock has fallen about 19.6% in one year, underperforming the S&P 500’s (SPX) nearly 29.4% gain. Macro headwinds, increased competition from emerging brands, and inventory issues have weighed on Nike’s growth rate, dragging its shares lower.

Nonetheless, Nike’s inventory issues have subsided, with units down and improved markdown rates. Further, the company is working to enhance its margins and improve its product innovation cycle to accelerate growth and drive profitability. With this backdrop, let’s look at Street’s forecast for Q3.

NKE – Q3 Expectations

Wall Street expects Nike to report sales of $12.27 billion, down 1% year-over-year. The company faces challenges from a heavily promotional environment in China, compounded by increased macro headwinds. Additionally, the comparison with a solid performance from the previous year, where Nike achieved double-digit growth, is expected to impact its revenue negatively.

Analysts expect Nike to report earnings of $0.76 per share in Q3, down from $0.79 in the prior-year quarter. A downward pressure on NKE’s sales will likely impact EPS. However, its bottom line could benefit from pricing actions, lower ocean freight rates, and improved supply chain efficiency.

Here’ What Website Traffic Indicates

While NIKE’s store traffic continued to grow, digital traffic softened and promotional activity increased in the previous quarter. This scenario is unlikely to change in Q3 as consumers remain cautious amid macro challenges.

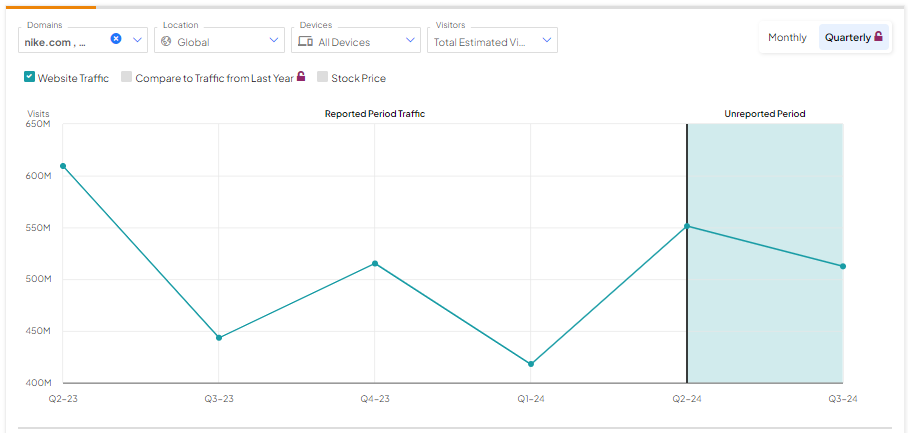

TipRanks’ website traffic screener shows that Nike’s traffic decreased sequentially in Q3. However, it improved year-over-year. According to the tool, the number of visits to nike.com and its other brand, converse.com, fell 7.1%% sequentially in the third quarter. However, website traffic improved 15.6% on a year-over-year basis.

Learn how Website Traffic can help you research your favorite stocks.

Is Nike Stock a Buy, Sell, or Hold?

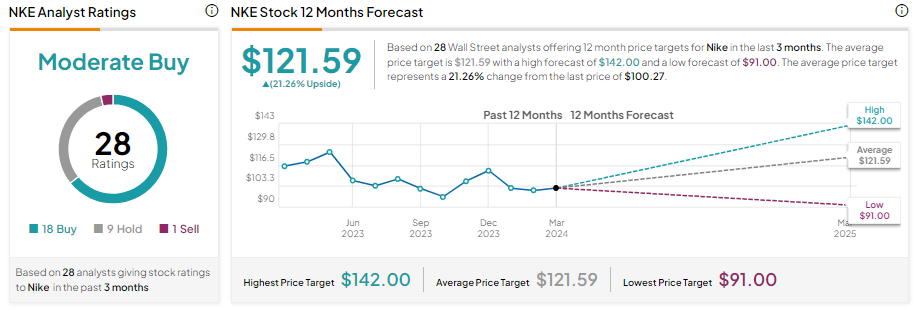

Wall Street analysts remain sidelined on Nike stock ahead of Q3 print. With 18 Buy, nine Hold, and one Sell recommendations, NKE stock has a Hold consensus rating. Analysts’ average price target on NKE stock is $121.59, implying a 21.26% upside potential from current levels.

Insights from Options Trading Activity

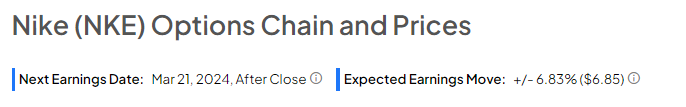

While analysts remain sidelined on NKE stock, options traders are pricing in a +/- 6.83% move on earnings, smaller than the previous quarter’s earnings-related move of -11.82%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

The ongoing macro headwinds and softness in China could adversely impact Nike’s financials in Q3, keeping analysts sidelined on NKE stock ahead of the Q3 print.