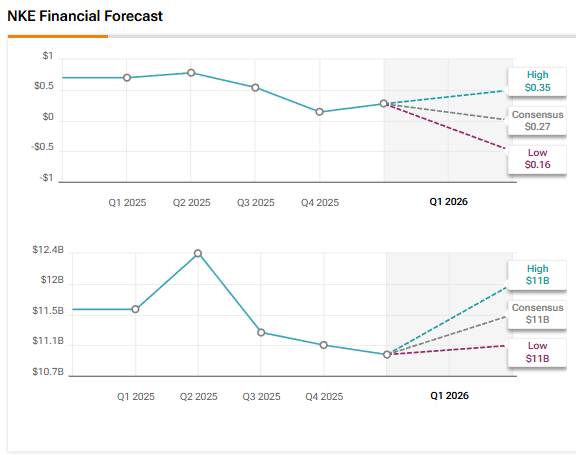

Athletic apparel and footwear maker Nike (NKE) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on Tuesday, September 30. NKE stock is down 8.4% year-to-date, as strategic missteps, a lack of innovation, tariff woes, and intense competition have impacted the company’s business. Wall Street expects Nike to report earnings per share (EPS) of $0.27 for Q1 FY26, reflecting a 61.4% year-over-year decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenue is expected to fall 5.2% to $10.99 billion. Nike has a solid track record of exceeding analysts’ earnings expectations for eight consecutive quarters.

Investors will focus on management’s commentary regarding the progress made on its Win Now strategy, which aims to turn around the business through various initiatives, including investing heavily in major sports events and key product launches, as well as expanding the marketplace.

Analysts’ Views Ahead of Nike’s Q1 FY26 Earnings

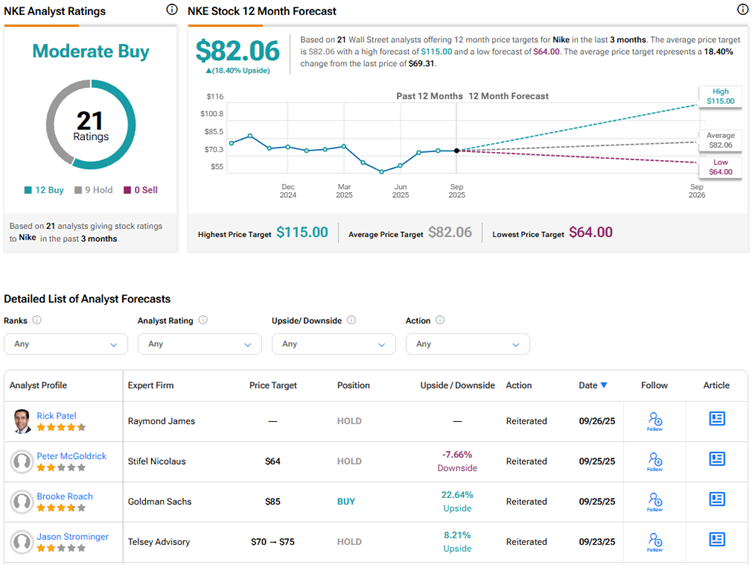

Heading into the Q1 results, Stifel analyst Peter McGoldrick reiterated a Hold rating on Nike stock with a price target of $64. The analyst views Q1 FY26 as a “meaningful milestone in NKE’s journey” to return to its former glory.

McGoldrick believes that a focus on performance innovation is the right strategy to restore an appropriate balance between lifestyle and performance themes. He contends that while Nike’s “turnaround is an eventuality,” investors are not being properly compensated for the risk of a potentially long recovery period.

Meanwhile, Morgan Stanley analyst Alex Straton increased her price target for Nike stock to $70 from $64, but maintained a Hold rating. The analyst increased NKE stock price target, citing a more favorable weighted average cost of capital (WACC). Straton said that she expects Q1 FY26 earnings to come in line with the Street’s consensus estimate, with a focus on the rate of change in revenue, potential downside in gross margin, and commentary for the second half of Fiscal 2026.

Straton thinks that the Street’s second-half and Fiscal 2026 EPS estimates are too high. The analyst added that her stance has become “incrementally negative” compared to three months ago due to less constructive recent channel checks in North America and the European Union and elevated valuation. Looking ahead, Straton expects the upcoming December channel checks and Nike’s Q3 FY26 results to be the key catalysts for the stock.

AI Analyst Is Cautious on Nike Stock Ahead of Q1 Print

Interestingly, TipRanks’ AI Analyst has assigned a Neutral rating to Nike stock with a price target of $78, indicating about 12.54% upside potential. TipRanks’ AI analysis reflects a mix of solid financial management and strategic initiatives amid ongoing challenges.

While Nike’s profitability and cash flows are strong, technical indicators and valuation suggest caution. Earnings call insights reflect a balanced view of near-term pressures and long-term growth potential.

Options Traders Anticipate a Major Move on Nike’s Q1 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about an 8.41% move in either direction in NKE stock in reaction to Q1 FY26 results.

Is NKE Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Moderate Buy consensus rating on Nike stock based on 12 Buys and nine Holds. The average NKE stock price target of $82.06 indicates 18.4% upside potential.