Streaming giant Netflix (NASDAQ:NFLX) made some gains today amid several new points of interest. First off, Bank of America came back to the table and reiterated its Buy rating. The second point, however, is a much stranger notion as Netflix gets into the restaurant business.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

To begin with, Bank of America Securities analysts took aim at Netflix and found they liked what they saw. Sufficiently so, in fact, to recommend that people buy in. It not only reiterated its previous Buy rating, but it also hiked the price target from its original $410 to its current $490. The upward revisions came as several third-party trackers revealed that the mass exodus away from Netflix in the face of the password-sharing crackdown was not to be. People subscribed, and Antenna revealed that, just after the crackdown, Netflix saw the four largest days of new users that it had seen in the four and a half years preceding it.

Huge developments and things only keep going. Perhaps in a bid to set up new income streams or just promote itself, Netflix announced plans to open a pop-up restaurant in Los Angeles. The restaurant, dubbed Netflix Bites, will offer a menu composed entirely of food found on Netflix shows. Dominique Crenn of “Iron Chef” will be involved, as well as Curtis Stone, Rodney Scott, Nadiya Hussain, and several other personalities. Even some beverages will be Netflix-related, as “Drink Masters” beverage makers will also be involved.

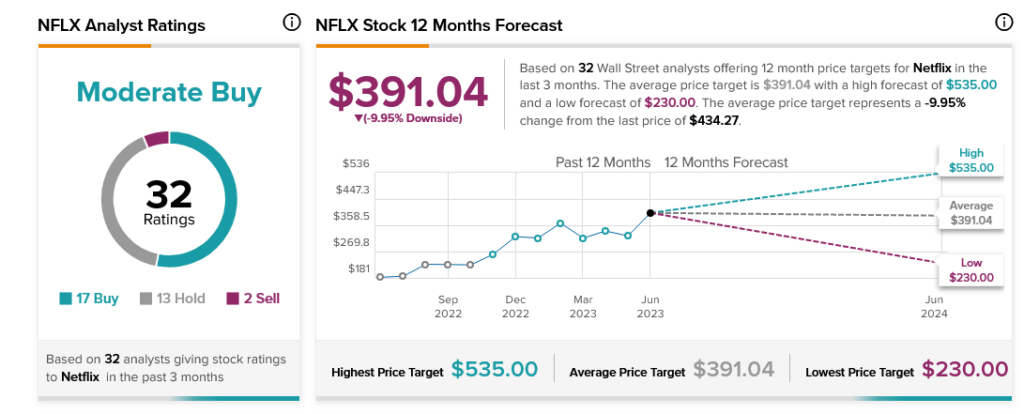

Analysts are somewhat split on Netflix’s overall future, expansion efforts aside. With 17 Buy ratings, 13 Holds, and two Sells, Netflix is currently considered a “Moderate Buy” by analyst consensus. However, with an average price target of $391.04, Netflix stock also carries 9.95% downside risk.