Lower drilling activity and economic uncertainty pose challenges for oilfield services companies, leading to consolidation in the industry. In light of this, a Wall Street Journal report highlighted that NexTier Oilfield Solutions (NYSE:NEX) and Patterson-UTI Energy (NASDAQ:PTEN) are engaged in discussions regarding a potential merger. Following the news, the shares of NEX are up about 7% in the pre-market session, while PTEN stock has seen a rise of over 12%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, shares of both NEX and PTEN are trading in the red on a year-to-date basis. Further, the NEX stock is down about 26% in one year, while PTEN dropped by over 39% during the same period.

Both of these companies remain upbeat and expect the demand environment to improve. However, the downtrend in oil and gas prices and economic uncertainty could negatively impact near-term drilling and completion activity and in turn, the performance of both of these companies.

A merger deal between the two could help create a larger company in the industry and expand its market share, the report highlighted. However, whether a deal will be announced remains a wait-and-see story.

Let’s check what analysts recommend for NEX and PTEN stocks.

Wall Street Analysts Remain Cautiously Optimistic

Over the long term, the demand for oil and natural gas is expected to increase. However, Wall Street analysts are cautiously optimistic about the industry due to declining activity in the near term. Oil and natural gas prices have steadily declined over the past year despite output cuts. Even the recent production cut by Saudi Arabia has failed to stabilize prices.

Goldman Sachs, which has been bullish about crude and other commodities, has lowered its oil price forecast. The financial services giant reduced the year-end forecast for Brent to $86 a barrel from $95.

The economic uncertainty and fear of a recession could hurt demand from oil and gas producers and weigh on the performance of oil-field services companies, including NEX and PTEN.

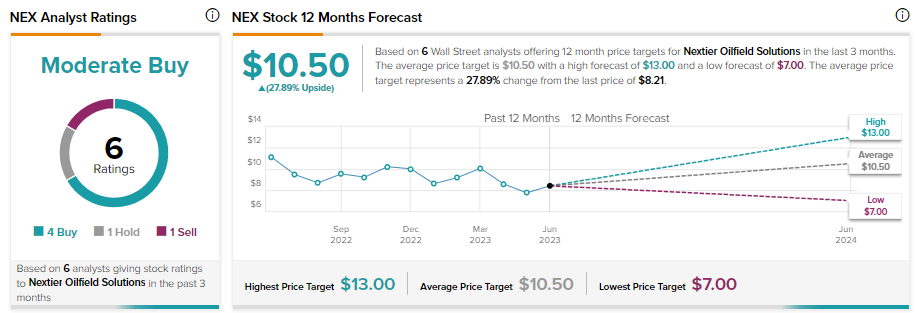

What is the Price Target for NEX?

NEX stock has received four Buy, one Hold, and one Sell recommendations for a Moderate Buy consensus rating. At the same time, analysts’ average price target of $10.50 implies 27.89% upside potential.

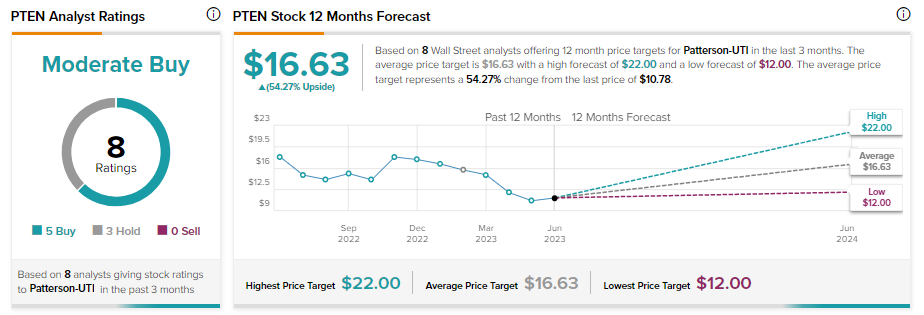

Is PTEN a Good Stock to Buy?

PTEN stock also sports a Moderate Buy consensus rating on TipRanks, reflecting five Buy and three Hold recommendations. These analysts’ average price target of $16.63 implies 54.27% upside potential from current levels.