Saudi Arabia, a dominant member of the OPEC+ (Organization of the Petroleum Exporting Countries and its allies) nations, said that it would cut oil production by 1 million barrels/day to stabilize crude prices. The move comes amid declining oil prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After a stellar recovery post-COVID, oil prices have steadily declined over the past year. Global economic uncertainty and weakness in China have weighed on crude prices, leading OPEC+ nations to cut output. However, Saudi Arabia was alone in announcing the latest round of additional production cuts, as other members plan to stick to their prior commitments until 2024.

The latest move by Saudi Arabia, the largest oil exporter, could help prop up prices. However, economic weakness could hurt demand.

While Saudi Arabia plans to drive prices higher, Goldman Sachs is bullish about crude and other commodities. The financial services giant stated that commodity demand didn’t deteriorate much and stayed steady regardless of the weak macro environment. On the other hand, underinvestment and tight supply could push prices higher.

Against this backdrop, analyst Michele Della Vigna sees “absolute value” in several companies, including Occidental Petroleum (NYSE:OXY), ConocoPhillips (NYSE:COP), and Marathon Petroleum (NYSE:MPC), in the energy sector.

The analyst expects OXY’s ability to generate robust free cash flows, underappreciated upstream assets, and solid earnings potential to drive its stock price. Meanwhile, the analyst is upbeat about COP’s long-term project queue in the Liquefied Natural Gas segment and attractive valuation.

As for MPC stock, the analyst has a positive view of the midstream market. Further, the company’s consistent earnings and solid capital returns support the bullish outlook.

While Goldman Sachs is upbeat about OXY, COP, and MPC stocks, let’s look at what analysts’ consensus ratings indicate for these companies.

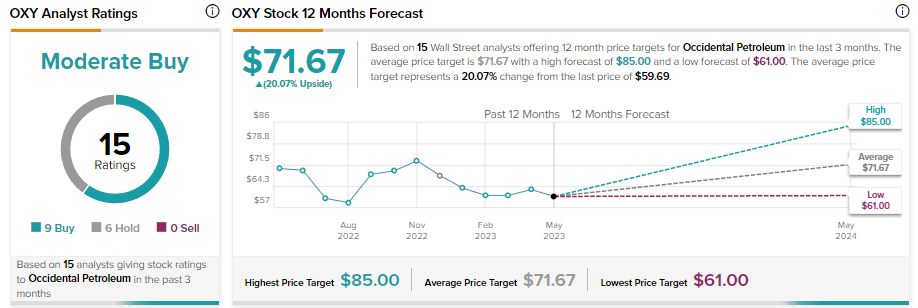

What’s the Prediction for OXY Stock?

While Goldman Sachs is bullish about OXY stock, it has received nine Buy and six Hold recommendations for a Moderate Buy consensus rating.

Further, analysts’ average price target of $71.67 implies 20.07% upside potential from current levels.

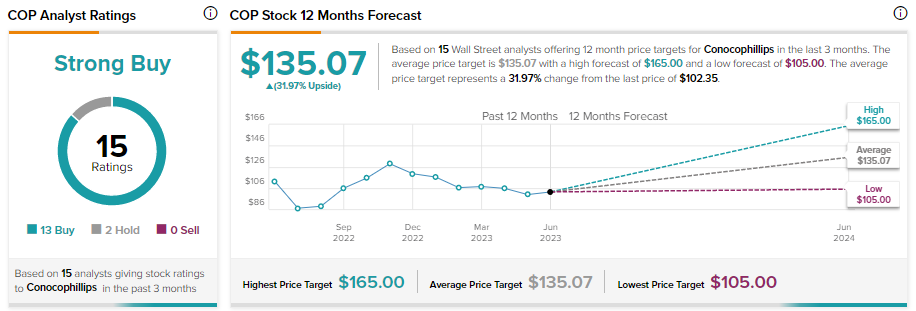

Is COP a Buy, Sell, or Hold?

COP stock sports a Strong Buy consensus rating on TipRanks. It has received 13 Buy and two Hold recommendations. Analysts’ average price target of $135.07 implies 31.97% upside potential.

Is MPC Stock a Buy or Sell?

With seven Buy and three Hold recommendations, MPC stock has a Moderate Buy consensus rating on TipRanks. Further, these analysts’ average price target of $143.67 implies 31.92% upside potential.