For a while, it looked like medical technology company GE Healthcare (NASDAQ:GEHC) might have some issues when it first came into view. Without the wider support of the rest of the GE brand to back it up, it could indeed have had some troubles. Today, we’re seeing why those fears were largely unfounded, as GE Healthcare turns up modestly with the introduction of some new technology.

The new technology in question is known as the Prostate Volume Assist (PVA) system. It uses artificial intelligence (AI) to assist with the volume measurements of a human prostate. Being able to accurately measure the prostate’s volume is one of the most useful means to determine if the prostate is cancerous or not.

It can also assist in treating other neurological disorders. The PVA system will be included with several GE Healthcare ultrasound systems and produce results that are both single-click easy and two-second rapid. Facilitating diagnoses like that should make the GE Healthcare line of ultrasound systems that much more attractive to physicians.

Further Developments Don’t Hurt Either

That wasn’t all GE Healthcare had to bring out. Now, it’s set to distribute the Ionic Health nCommand Lite system thanks to some recent greenlighting from the FDA. The nCommand Lite system was meant to help take some strain off radiology departments in hospitals, which have been suffering from acute staffing shortages in recent months. With nCommand Lite, users can perform patient scanning functions remotely and review images in real-time.

Is GE Healthcare a Good Stock to Buy Now?

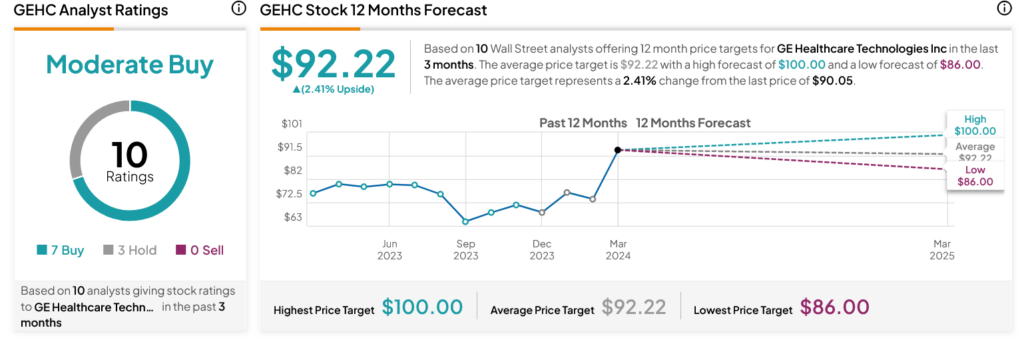

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GEHC stock based on seven Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 17.26% rally in its share price over the past year, the average GEHC price target of $92.22 per share implies 2.41% upside potential.